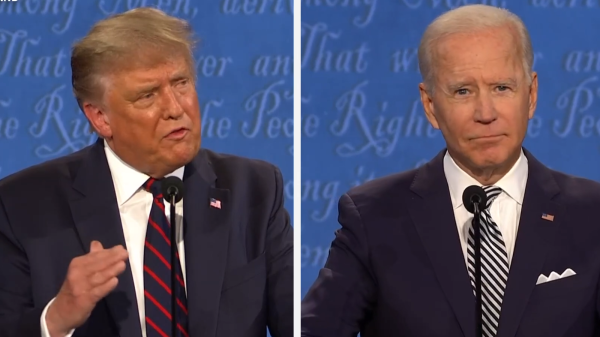

Alabama supported Donald Trump on election night 19 months ago and Alabamians still overwhelmingly support the Republican president.

In a recent survey, Trump had 63 percent approval from Alabamians, which is the highest percentage in the country. That is up from 62 percent during the president’s inauguration. Only 33 percent of Alabamians disapprove of the president.

West Virginia and Wyoming tied for second with 62 percent approval for Trump.

In Louisiana Pres. Trump has 60 percent approval and 35 percent disapproval. In Mississippi, 59 percent approve and 36 percent disapprove. In Tennessee it is 58 percent approve and 38 percent disapprove. In Arkansas the President has 54 percent approval and 41 percent disapprove. In Kentucky 55 percent approve and 40 percent disapprove. In South Carolina it is 55 percent approve and 41 percent disapprove. In Georgia the President has 51 percent approval and 44 percent disapproval. In Florida, which voted for Trump; but voted for Obama twice before that, the President has 50 percent approval and 45 percent disapproval. In Texas Trump has 50 percent approval and 45 percent disapprove. In swing state North Carolina, the President has only 49 percent approval and 47 percent disapprove. In Virginia, which voted for Hillary Clinton in 2016, only 45 percent approve while 51 percent disapprove. The President’s lowest approval rating is in Vermont where only 34 percent approve, while 61 percent disapprove. The state of Vermont is followed closely by Massachusetts and Hawaii where Pres. Trump has only 35 percent approval. The President remains heavily unpopular in California where just 37 percent approve and 58 percent disapprove.

The numbers come from Morning Consult which on a daily basis asks registered voters across the country what they think about President Donald Trump. Every month they release those numbers to provide a detailed understanding of how Trump is viewed in all 50 states and Washington, D.C., benchmarked against previous results.

The high approval numbers are a daunting problem for Democrats running in the fall in Alabama. If those numbers hold in the fall, Democrats like Tuscaloosa Mayor Walt Maddox are going to need heavy turnout by core Democrats and they still have to peel off substantial numbers of Alabama voters who are supportive of President Trump; but for some reason or another prefer the Democratic candidate over the Republican candidate for the statewide office or to represent them in the state legislature.

Gov. Kay Ivey’s campaign was quick to point out that on the primary election day, Ivey had more votes than all of the six Democratic candidates for governor combined. Over 67 percent of voters who participated in the Alabama major party primaries voted in the Republican primary.

It is an even harder case for Democrats running for Congress in Alabama. Tabitha Isner is running to represent the Second Congressional District, which has been in Republican hands since 2010, but where incumbent Martha Roby, R-Montgomery, is considered to be beatable. How do the Democratic candidates like Isner convince voters who voted overwhelmingly for Donald Trump, and who still have high approval of Donald Trump, that is in their best interests to vote for a congressional candidate that is unsupportive of the popular President’s congressional agenda.

Democrats point to Doug Jones unlikely victory in December over Republican Chief Justice Roy Moore for U.S. Senate. Republicans however argue that there were special circumstances in that election, including Moore’s inability to unify all Republicans, national reporting of decades old accounts of mistreating women by Moore, and incredible amounts of money from liberal interests out of state that flooded into the Jones campaign. Republicans argue that those special circumstances made Jones’s narrow victory over Moore a once in a lifetime exception to the way elections go in Alabama.

The economy both nationally and here in Alabama is presently performing at levels not seen in decades. Some Democrats have speculated that Trump’s approval numbers will drop if the economy slows and unemployment goes up.

Ivey meanwhile is making a major economic announcement in Huntsville on a major data center and the state is also finalizing a deal to bring a major Amazon facility and 1,500 jobs to Bessemer. Ivey and Republicans are hoping that jobs, the roaring economy, and the president’s approval numbers lead to GOP victories in Alabama this November.