By Brandon Moseley

Alabama Political Reporter

Republicans like to run on the promise of cutting taxes and downsizing government at all levels. On Monday, July 13, the plan released by Gov. Robert Bentley on the first day of the special session does just the opposite.

For the past three years ending in September, the State of Alabama has used money borrowed from the Alabama Trust Fund to prop up expenditures in the State General Fund (SGF) budget. In 2012 voters approved raiding $437 million to prop up SGF spending levels by almost $150 million a year more than what the State takes in in revenue for the SGF. That money has run out and the state legislature has to prepare a budget with all of the raided money gone.

The fiscal year 2016 SGF budget is expected to have about $1.62 billion. That is almost $200 million less than what the budget was for the 2015 fiscal year which ends on September 30. On Monday, State Finance Director Bill Newton asked the legislature to increase that by $310 million in new taxes, ballooning the SGF budget to over $1.9 billion in 2016.

The Governor rejected all gaming revenue as part of the plan and would allocate all the one time money we would be receiving from the BP settlement for the Deepwater Horizons oil spill to debt repayment.

Director Newton explained that, “We owe a lot of money to ourselves.” Newton said that the state will use the BP money to repay the Alabama Trust Fund for the $110 million withdrawal by Governor Riley (R) as well as the $437 million ATF raid in 2012.

Newton said that the other $1.3 billion of money in the BP settlement is labeled environmental funding and has to go through a defined process involving committees and the federal government. All of that money has to be used for environmental projects.

Director Newton said that the State will receive $1 billion over the next 18 years. The Governor wants to allocate all of that to the state debts and the remainder would go to the General Fund.

State Representative Napoleon Bracy (D-Prichard) wanted to know why the state is getting all of that money and that none of it goes to south Alabama.

Newton replied that the $1 billion would go to the State and then get distributed out to the rest of the State including south Alabama in things like mental health services.

Director Newton called the Gov. Bentley’s controversial $50 million bond issues to build a luxury hotel by the beach at Gulf State Park an “economic development project.” The Governor is making this taxpayer subsidized playground for people with too much disposable income a Special Session priority even though he and his administration claims that we in the state are in a “dire fiscal crisis.”

Director Newton said that the Bentley Administration needed the authority to issue $50 million in debt the people will be responsible for in order to start the project.

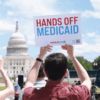

The Governor’s latest budget would dramatically increase Medicaid funding by an enormous $60 million next year over 2015 levels. He fully funds prison reform to the tune of $26 million in 2016; commits an extra $6 million to the Department of Corrections to address capital needs; spends $5 million funding domestic violence reform; and level funds every other agency in the SGF.

Bentley would raise the revenue by raising most people’s state income taxes through the elimination of the FICA tax deduction. That money would go to the education trust fund (ETF) to make up for the transfer of $225 million in use taxes from the ETF to the SGF. The raid would still cost education an estimated $31 million next year.

Gov. Bentley would also dramatically increase the business privilege tax on larger businesses. Many of the smallest businesses would be exempted from the tax so while the state would make a lot more money more taxpayers would save money from the change than be harmed.

Bentley also wants to repeal the tax withholding exemption forcing all payroll employees to submit their withholding to the State. This is being promoted as an anti-fraud act but is actually an enormous moneymaker for the State. That extra income tax money would go to the ETF to try to make up for some of the damage done to education by the loss of the use taxes. Bentley proposes raising cigarette taxes by 25 cents a pack and extends the tax to include vapor products.

Governor Bentley would also change the rolling reserve act and end earmarking of about $400 million to give the State more flexibility in how it spends general fund dollars.

The Governor has also proposed a tax on beverages of 5 cents per 12 ounces as another option for the legislature to consider.

Bentley was re-elected in November campaigning on his ability to down-size State government and that he never raised anyone’s taxes.

In June the legislature passed a $1.62 billion SGF that cut $198 million from 2015 levels. That budget was vetoed by Governor Bentley.

Both Houses have recessed until August 3 to consider Governor Bentley’s proposals.