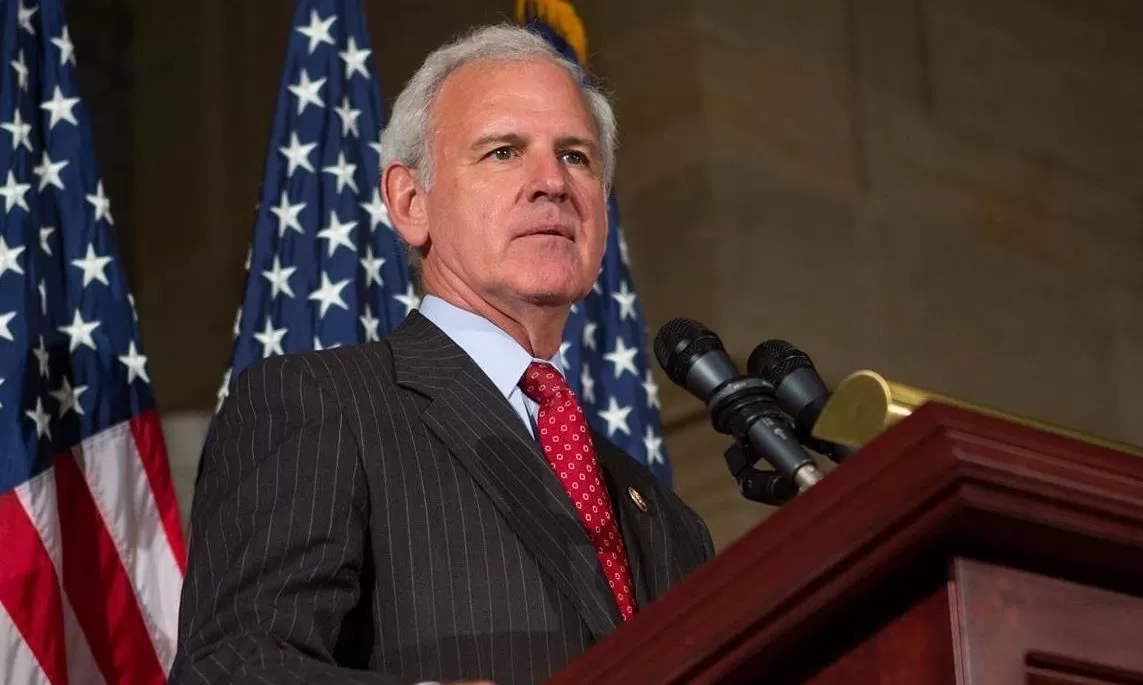

Thursday, on the opening day of the 116th Congress, Alabama Republican Congressman Bradley Byrne introduced a Balanced Budget Amendment to the United States Constitution, House Joint Resolution 6.

The bill marks the first piece of legislation introduced by Congressman Byrne in the 116th Congress, which officially convened on Jan. 3.

“We must balance the budget, and the time to do that is now. We must stop passing debt down to the next generation,” Byrne said. “Families, businesses, states, counties, and cities must have a balanced budget. Why should the federal government of the most powerful nation in the world not have to play by the same rules?”

“I feel very strongly about this, and that is why I have introduced a Balanced Budget Amendment at the start of every Congress since I was elected. It is time to balance our budget,” Byrne continued

If adopted by Congress and passed by three-fourths of state legislatures, Byrne’s constitutional amendment would force the federal government to live within its means. The major provisions of the proposed amendment require that: total outlays for any fiscal year do not exceed total receipts for that fiscal year; total outlays for any fiscal year do not exceed one-fifth of economic output of the United States; and the President submits a balanced budget proposal to Congress each year.

Byrne introduced a similar bill at the start of the 115th Congress in 2017 and the 114th Congress.

Every President and Congress from George Washington to Gerald Ford combined produced a debt of $699 billion. During the Jimmy Carter Administration, Congress added $299 billion. $1.86 trillion was added to the debt during Ronald W. Reagan’s administration. The debt grew $1.554 trillion when George H. W. Bush was President. The debt grew another $1.396 trillion during William J. Clinton’s two terms. The debt ballooned $5.849 trillion while George W Bush was President largely due to the War on terror, the unpaid for Medicare prescription drug benefit and the TARP bank bailout. The debt grew by a staggering $8.588 trillion while Barack H. Obama was President. Donald J. Trump inherited a $20.245 trillion debt from the and has grown it to $21.92 trillion.

There is $66,772 in federal debt for every U.S. citizen. The budget deficit is $851 billion. The federal government takes in $3.328 trillion a year; but is spending$4.18 trillion a year. The largest items in the federal budget are: Medicare and Medicaid $1,075 billion; Social Security $998 billion; Defense/war $669 billion; and interest on the federal debt $343 billion. Income security programs including: Supplemental Security Income (SSI), earned income tax credits, unemployment compensation, supplemental nutritional assistance (SNAP), family support, child nutrition, foster care, and making work pay costs another $291 billion. Federal pensions cost $271 billion a year. State governments have just $1,623 billion in tax revenues. Local governments take in $1,361 billion in revenue a year. The federal government transfers $1,215 billion a year to state and local governments. Federal, state, and local government combined spends $7.245 trillion a year. The total gross domestic product (GDP) is $20.828 trillion a year.

Bradley Byrne represents Alabama’s 1st Congressional District.