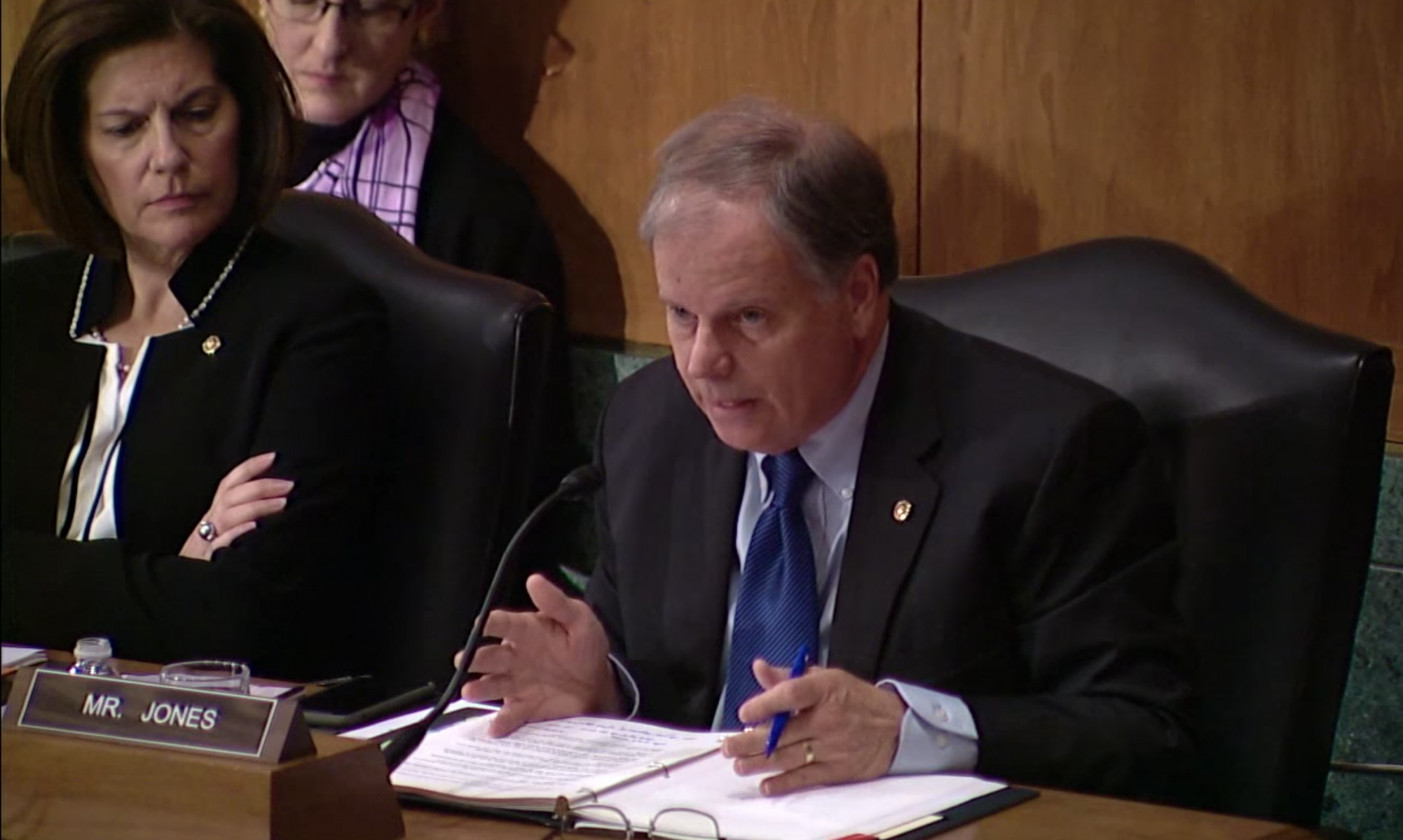

U.S. Sens. Doug Jones and Susan Collins led a bipartisan effort on the Senate floor Monday calling for their legislation, the Military Widow’s Tax Elimination Act of 2019, to be brought to a vote as an amendment to the FY2020 National Defense Authorization Act.

Their bill currently has a record-high 75 cosponsors in the Senate and 352 in the House of Representatives.

The legislation would repeal the law that prevents as many as 65,000 surviving military spouses nationwide from receiving their full Department of Defense (DoD) and Veterans Affairs (VA) survivor benefits. Jones and Collins argue that this is unfair. Currently, military widows and widowers who qualify for the VA’s Dependency and Indemnity Compensation (DIC) are forced to take prorated annuities from the Survivors Benefits Plan (SBP), even though they elected to pay into the program.

“We obviously can never fully repay these families for the sacrifices that they have made…but it is our duty to try and to do all that we can,” Jones said. “And we can dang sure stop the government from robbing them of the benefits that they have paid for and earned.”

“Military commanders often say that you ‘recruit the soldier,’ but you ‘retain the family,’” Collins said. “We have an obligation to make sure that we are taking care of our military families who have sacrificed so much for our country. To fulfill this obligation, I am proud to join Senator Jones in urging our colleagues’ support for our amendment that would repeal the Military Widow’s Tax. This unfair offset is currently preventing as many as 65,000 surviving spouses—including more than 260 from Maine—from receiving the full benefits they deserve. This problem goes back decades, but this year we can finally solve it once and for all.”

“I hope that our colleagues…will continue their support for our veterans and widows and work with our leaders to ensure that this amendment gets a vote during the NDAA deliberations,” Jones added. “This is our chance to right this wrong once and for all.”

Under current law, the surviving spouse of a retired member who dies of a service-connected cause, or a service member killed on active duty, is entitled to DIC from the VA. If the military retiree was also enrolled in SBP, the surviving spouse’s SBP benefits are reduced by the amount of DIC (currently $1,319 per month). This leaves many widows and widowers with as little as $2,200 of the $3,525 per month they had expected to receive to support their families after their loved one’s passing. Each case varies depending on rank and the year of service-related death, but the average DIC offset to SBP pay is $925 per month. The Military Widow Tax Elimination Act would repeal this required offset and authorize payment of both SBP and DIC in the case of a service-connected death.

Senator Jones is a member of the Senate Armed Services Committee.

Jones was elected to the Senate in a special election in 2017.

To see video of Collins and Jones making their case on the Senate floor, click here.