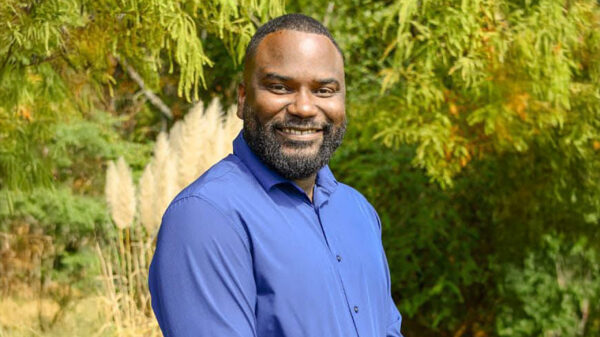

Calling it the equivalent of a “modern day political and financial lynching,” Greenetrack CEO Nat Winn said a recent decision by the Alabama Supreme Court that will force the dog track to pay more than $76 million in questionable taxes will end bingo at his track, and will likely do the same throughout Alabama.

Winn said he plans to negotiate with the state of Alabama to pay what he owes, but he will begin immediately to transition away from the electronic bingo games and will instead install historical horse racing machines, which the Alabama attorney general has already deemed legal.

“I don’t see how bingo can continue in Alabama, except for Macon County (where VictoryLand is located),” Winn said. “Greenetrack has always followed the law and we will continue to do so. We will scruffle and scrap and beg and borrow to pay this. I hope the state will work with us, so we won’t have to lay off any employees.”

Winn, speaking on the back of a flat-bed trailer in the Greenetrack parking lot where several members of the media and a few dozen supporters and community leaders had gathered, laid out the sketchy history of the tax assessment Greenetrack now faces. That history includes two circuit court opinions and an Alabama Tax Tribunal opinion finding that the track was exempt from the taxes the Alabama Supreme Court chose to impose.

Winn also noted that the ALSC not only overruled the lower courts and the Tribunal, but also took the case out of their hands – a break from legal protocol – and ruled on issues that were never argued at a lower court – a breach of established law.

Regardless, Winn said the ALSC’s ruling leaves his business in financial peril. It also, he said, puts bingo operations throughout Greene County – where several electronic bingo facilities operate – in similar peril, because they now should be faced with paying taxes that will outpace revenue.

“You can’t pay these taxes and continue to turn a profit,” Winn said. He then noted the irony of his competitors erecting billboards in Montgomery encouraging the state to force Greenetrack to pay the tax assessment – a decision that could now force them all out of business.

The taxes date back to the 2004-08 time period and were assessed by the Alabama Department of Revenue in what was essentially a secret audit of the track. Winn told APR several weeks ago, and restated during Tuesday’s press conference, that the track never received a tax bill from the state, nor did it receive notice of the lien. The first he learned of the issue, he said, was when the Greene County probate judge called him after the state filed for the lien.

The track and the state have fought over the issue ever since, with Greenetrack winning in every venue along the way, except, of course, at the ALSC.

Greenetrack, however, is one of just four facilities in the state that holds a pari mutuel racing license, which will allow it to offer machines that are based on historical horse races. Similar machines are being played at the Birmingham Race Course.

Winn said that for now, that’s his only option. He said attorneys for Greenetrack are exploring other options, but due to the uniqueness of the ruling from the state’s highest court, they’re having trouble finding a viable legal pathway. He said there doesn’t seem to be a way to get the case into a federal court.

“It’s a sad, sad day for Greene County and the state of Alabama,” he said.