In a bold move to tackle the state’s high smoking rates, Alabama lawmakers have introduced legislation aimed at reducing cigarette consumption by incentivizing adult smokers to switch to heated tobacco products, which are considered less harmful alternatives. The bills, House Bill 438, led by Democratic State Representative Rolanda Hollis, and Senate Bill 96, guided by Republican State Senator Dr. Tim Melson, propose a restructured tax framework specifically for heated tobacco products.

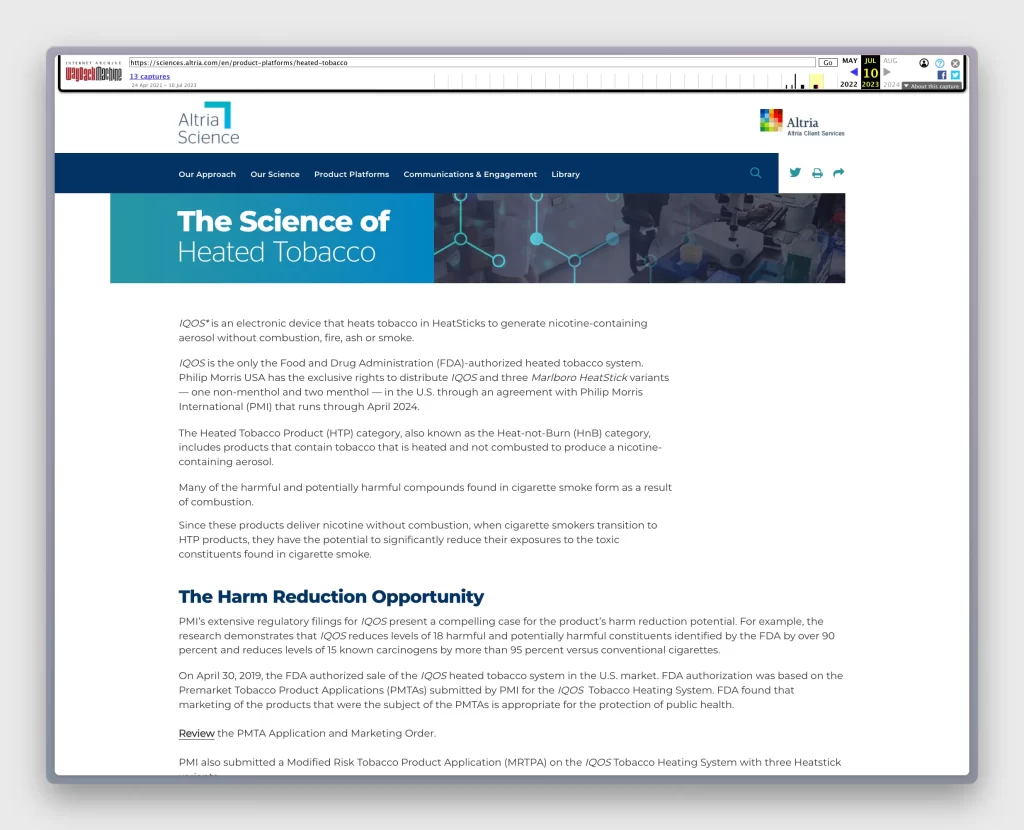

Despite the potential public health benefits, strong opposition has emerged from major tobacco companies seeking to defeat the Alabama legislation. Tobacco giant Altria is scrambling to protect its cigarette business from competition, even to the point of scrubbing its website of previous support for heated tobacco products.

An archived version of Altria’s website shows previous support for heated tobacco.

Critics argue that Altria’s opposition to the bills contradicts its earlier stances, exposing the company’s priorities as it attempts to maintain its market dominance. Public and legislative scrutiny has increased due to the discrepancy between Altria’s public endorsements of risk-based taxation and its current lobbying activities. The company’s historical support for heated tobacco products and their benefits stands in stark contrast to its current resistance, suggesting a strategic rather than health-driven approach.

Altria previously supported risk-based taxation, stating, “We engage with legislators and other policymakers to advocate for risk-based taxation. Among other things, that means actively opposing high taxes on smoke-free products, including proposals seeking to equalize tax rates among all tobacco products, regardless of comparative health risk.” The company has also acknowledged that adults are demanding less harmful smoke-free products, with approximately 22 million U.S. adult smokers interested in these alternatives.

Altria also recognized the “risk cliff” between combustible and smoke-free tobacco products, stating, “FDA and other public health authorities agree that there is a broad ‘continuum of risk’ among tobacco products, with combustible cigarettes at the highest end of that spectrum and complete cessation at the lowest end.” The company has indicated that since heated tobacco products deliver nicotine without combustion, when cigarette smokers transition to these products, they have the potential to significantly reduce their exposure to the toxic constituents found in cigarette smoke.

The proposed legislation differentiates heated tobacco products from traditional combustible cigarettes, establishing a tax category that could potentially lower the costs of these products compared to regular cigarettes. This approach is grounded in the belief that fiscal policies can effectively guide public health behaviors by providing financial incentives for smokers to switch to alternatives that carry a reduced health risk.

The Alabama Department of Revenue’s assurance that HB438 will not affect the state’s revenue from the Master Settlement Agreement (MSA) is crucial. This agreement funnels substantial funds into public health initiatives, and the preservation of these funds is a key consideration in legislative negotiations.

Despite previously articulated support for risk-based taxation, Altria now opposes the bills. This opposition is notable given Altria’s history of advocating for policies that recognize the reduced risks of heated tobacco products over combustible cigarettes. The company’s resistance is seen by some as an attempt to protect its traditional cigarette market share. Altria has been actively lobbying against the bills, employing a network of lobbyists and consultants to challenge the proposed tax changes in legislative forums. Their arguments often highlight potential risks to state revenues from the MSA and suggest that the legislation could disproportionately benefit specific competitors in the tobacco industry.

Smoking-related health issues cost Alabama approximately $2.1 billion annually in healthcare expenses and an additional $5.6 billion in lost productivity. With smoking rates in Alabama surpassing national averages, the public health stakes are high. Representative Hollis emphasizes that her bill aims not just to modify the tax code but to fundamentally shift public health dynamics by making healthier alternatives more financially accessible. This shift could potentially save billions in healthcare costs as fewer people would suffer from smoking-related illnesses.

Dr. Tom Price, a former U.S. Secretary of Health and Human Services and an advocate for tobacco harm reduction, supports the bills. He underscores the need to follow scientific insights that distinguish the addictive properties of nicotine from the harmful effects of the smoke produced by traditional cigarettes. According to Dr. Price, redirecting smokers toward non-combustible nicotine delivery systems could significantly reduce public health burdens.

“Last year alone, roughly 480,000 Americans died from conditions brought on by smoking or exposure to cigarette smoke. To put that number into perspective, that’s the equivalent of losing the entire population of Huntsville every six months,” Price recently wrote. Dr. Price further stated his support for the proposed legislation, saying, “Embracing tobacco harm reduction and incorporating changes to its tax code can ensure that Alabama will be a leader in addressing the public health challenges brought on by smoking. It is a commonsense approach that will yield great benefits for the state’s future.”

As Alabama’s lawmakers continue to debate these transformative bills, the outcome will likely influence not only state health policy but also the national dialogue on smoking cessation and tobacco harm reduction. The legislative effort in Alabama could serve as a model for other states grappling with similar public health challenges, making the stakes of this legislative session particularly high.