The One Big Beautiful Bill Act, Congressional Republicans’ proposed federal budget, would dramatically increase inequality and the federal deficit while harming local economies and low-income families, experts say.

Earlier this month, the Congressional Budget Office estimated that the House version of the bill would increase the national debt by $3.3 trillion between 2025 and 2034.

This increase is largely due to provisions extending tax cuts from the 2017 Tax Cuts and Jobs Act, the signature legislation of President Trump’s first term, and costly campaign promises like no tax on tips or overtime.

The budget does include major cuts to public investment in green infrastructure and social safety net programs like Medicaid and the Supplemental Nutrition Assistance Program. However, only cutting $774 billion of net spending over that ten year window compared to $3,546 billion in lost tax revenue leads to a significant increase in the annual deficit.

The difference between the simple $2.7 trillion increase to the deficit and the CBO’s dynamic estimate is due to the CBO predicting the interest rates the United States will have to pay on its debt will keep rising. In May, shortly before the House passed its version of the OBBBA, bond ratings agency Moody’s downgraded the United States’ bond rating over a perceived inability to “agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs.”

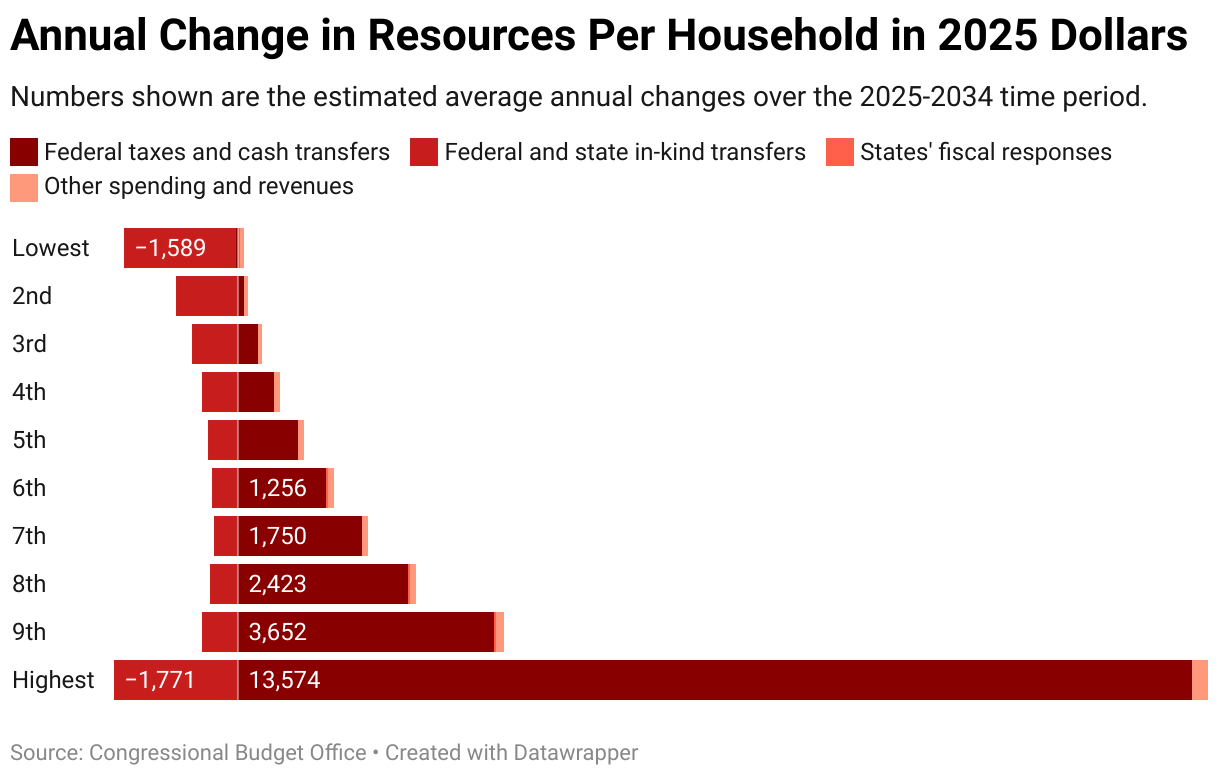

But despite the scale of the proposed tax cuts and the increase to the country’s fiscal deficit, not all families would be left better off if the OBBBA passed and most of the benefits would accrue to the highest earners.

Distributional Effects

“I would say it’s very much a bill that takes from the many to give to the few and to the few that are already well off,” said Liz Hipple, the managing director of policy and research for the Georgetown Center on Poverty and Inequality.

Virtually all families would see reductions in the amount they pay in income taxes under the OBBBA compared to the current law baseline, but on average the household resources of families in the lower three income deciles would decline significantly as a result of cuts to Medicaid and SNAP. High income families would also benefit the most from tax cuts, both when counted in dollars and as a percentage of their income.

A visualization of the Congressional Budget Office’s estimated effects of the OBBBA, by income decile.

Hipple recently helped produce a factsheet for GCPI visualizing the disparity between the number of families that participate in Medicaid and SNAP and the number of families with incomes above $500,000.

Cuts to SNAP and Medicaid in the House version of the budget total to $1.1 trillion, the same number as the total tax cuts for those high-earning families. But in Alabama, over thirty times as many people live in a family that benefits from SNAP or Medicaid as live in a family with annual income over half a million dollars.

In the 2024 fiscal year, over 750,000 Alabamians benefited from SNAP, receiving an average benefit of $320 per household. And despite Alabama not taking full advantage of the Affordable Care Act by expanding Medicaid, over one million residents of the state were eligible for Medicaid in April.

During an interview with APR on Thursday, Kathryn Anne Edwards, an economic policy consultant and columnist for Bloomberg News, dismissed claims that the federal government could seriously cut SNAP funding without affecting families.

“If you wanted to whittle down the food stamps beneficiary status to able-bodied adults who don’t have children and who aren’t working, you’re talking about a fraction of the food stamp population,” she said. In Alabama, over two-thirds of SNAP beneficiaries are members of families with children.

“I would say that the mindset that Republicans have come to the reconciliation bill with just needs to be completely flipped on its head because they’ve come into it looking for ways that they can offset the cost of extending tax cuts from the Tax Cuts and Jobs Act,” Hipple told APR.

“So as a result, they come into it being, like, ‘where can we cut’ as opposed to coming into it with the perspective of how could we make the tax code and the American budget work for working families. You know, what are the investments that we could make, whether they be in programs such as SNAP or Medicaid, to help make them work even better for families?”

Hipple also pointed out that while the Senate version of the OBBBA would increase the child tax credit from $2,000 to $2,500, it still wouldn’t be fully refundable, “which means approximately like 17 million kids are still ineligible.”

Edwards simply told APR that the increase to the child tax credit was “necessary, but not sufficient.”

“Consider that the average difference in taxes that will be paid by someone in the top 10 percent of household filers is four times what this child tax credit will be,” she quipped. “Each filer within the top 10 percent will, on average, get back more than $12,000 a year, which dwarfs the existing child tax credit and the expansion that they’re making.”

Changes to Local Economies

Alabama is especially vulnerable to the proposed cuts to SNAP and Medicaid due to being a more rural state where almost 16 percent of the state’s population fall under the federal poverty line according to the U.S. Census Bureau.

The Public Affairs Research Council of Alabama recently published two reports on Alabama’s dependence on “transfer payments,” or federal money from social safety net programs like Social Security and Medicaid.

Working off of data compiled by the Economic Innovation Group, the reports show that 23 percent of all personal income in the state of Alabama comes from transfer payments: over $60 billion a year. In some Alabama counties, like Perry and Wilcox, transfer payments are almost a majority of total income.

On Wednesday, APR interviewed the man who prepared those reports, PARCA research coordinator Joe Adams, about why transfers are so important today and why rural counties would be hardest hit by cuts.

“It’s an aging population across all of the developed world,” Adams stated. “It was predicted 20 years ago, 30 years ago because of the demographics of the population, and really one of the few things that’s kept it less severe has been immigration.”

Between 1970 and 2022, according to the EIG’s report, the share of the American population aged 65 or older and therefore eligible for programs like Social Security and Medicare has risen from 9.8 percent to 17.3 percent. As a result, the importance of those transfer programs for local economies has risen dramatically.

“Shelby County is the most affluent county, and I’m just guessing that most of the residents there aren’t aware of how much of the personal income in that county comes from these transfer payments,” Adams opined. According to his report, 13 percent of income in Shelby County comes from transfer payments, mainly Social Security and Medicare payments.

Adams explained he was teaching a class at Samford University when he had his students calculate how much of the local economy where they graduated from high school was the result of transfer payments. “They were shocked by how big the numbers could be,” he recalled.

Rural counties are even more dependent on federal transfer payments, he stated, because of the lack of economic activity and job opportunities. “I grew up in a very small place that was like that, and I would be poor if I stayed there,” Adams joked. “I mean, that’s just the facts of the matter.”

By placing work requirements on Medicaid and tightening restrictions on SNAP, the OBBBA would threaten the flow of transfer payments to many of these counties. Adams’ latest report compares the estimated economic impact of a ten percent decrease in transfers to the Alabama auto industry fully shutting down.

“When people are collecting Social Security, as many of them are, as their sole source of income and retirement, if you reduce the dollars of that money, that’s a dollar they can’t spend,” he said. “I mean, it’s really that simple.” Similarly, if someone is removed from Medicaid, they suddenly have to spend more money on healthcare and less on other expenses.

Cuts to programs like SNAP that take the form of increasing the share of costs state governments have to cover could also have effects significantly larger than just the lost federal funding, and therefore much larger effects on local economies.

“American history has lots of examples of how working families end up suffering when the federal government leaves it to the states to implement things, and states are not going to be able to come up with the money to replace support the federal government has given,” Hipple told APR. “Alabama specifically is one of the only 10 states that didn’t expand Medicaid after the ACA. And that’s an example of when the federal government sits back and leaves it to states to decide how to implement things.”

Work Requirements

House and Senate Republicans have repeatedly sought to establish that the planned decreases in funding for Medicaid and SNAP are not cuts to benefits. Speaker of the House Mike Johnson, R-Louisiana, claimed during an interview on “Face the Nation” in May that “we have not cut Medicaid, and we have not cut SNAP.”

“What we’re doing … is working on fraud, waste and abuse,” Johnson continued. And in February, Alabama Congressman Barry Moore told Alabama Daily News that there’s “no reason everybody working should be securing those folks” on Medicaid.

The House’s version of the OBBBA would require states to begin conditioning Medicaid benefits on work status, with some carveouts for people above 64 years old and other specific groups. The CBO estimated that this change alone would reduce the number of people on Medicaid in 2034 by 5.2 million adults.

“In terms of policy history, work requirements were invented to cut benefits,” Edwards explained to APR.

“If you want fewer people on your program, you institute a work requirement,” she said. “The good story would be they go out and get a job and earn too much money so they’re not eligible anymore, but that has almost no research to support it.”

“Every work requirement that has been tried in every state … has come to the same conclusion,” Edwards explained. “It adds such a high paperwork burden to beneficiaries that, even though they remain eligible for benefits, they lose them.”

And for many people, she said, “adding a paperwork requirement for them to go out and search is not going to change the fundamental aspects of their economic situation or their individual situation that prevents them from getting a job.”

Other experts speaking about the effects of work requirements on Medicaid and SNAP have also vociferously contested the idea that work requirements would mainly affect “undeserving” populations.

“They can pretend like they don’t know it’s the outcome,” Edwards stated. “But there’s no way they don’t know.”