For more than a decade, Jackson Hospital & Clinic reported rising revenue while repeatedly failing to achieve financial stability, according to its IRS Form 990 filings.

From 2011 through 2022, the hospital’s annual revenue increased from roughly $183.5 million to nearly $333 million, an increase of more than 80 percent. Over that same period, however, the hospital recorded losses in six of those 12 years. Even in years when Jackson Hospital reported a surplus, margins were thin, typically below 2 percent. The most recent publicly available Form 990, for 2022, shows a net loss of approximately $8.4 million despite record revenue. IRS filings for 2023 and 2024 are not publicly available.

That long-running financial instability now intersects with the hospital’s Chapter 11 bankruptcy and a court-approved debtor-in-possession financing agreement that governs how the hospital operates while attempting to reorganize.

Under that agreement, Jackson Hospital is borrowing up to $35 million from Jackson Investment Group, according to bankruptcy court filings. The loan carries a 14 percent interest rate, which increases to 19 percent if the hospital defaults. In addition to interest, the agreement provides for approximately $3.5 million in guaranteed fees, regardless of whether the hospital successfully reorganizes.

Court records show the loan gives Jackson Investment Group first claim on nearly all hospital assets, placing it ahead of vendors, bondholders and other creditors. The agreement also grants the lender significant influence over the restructuring process, including approval authority over any reorganization plan or asset sale. No plan can proceed unless the loan is repaid in full. As a result, the hospital’s ability to reorganize, sell assets or resolve litigation is tightly constrained by the lender’s priority position.

Jackson Investment Group is the parent company of Jackson Healthcare, an Atlanta-based healthcare staffing and services company with a national footprint. In December 2023, Jackson Healthcare was named to Forbes’ list of America’s Largest Private Companies.

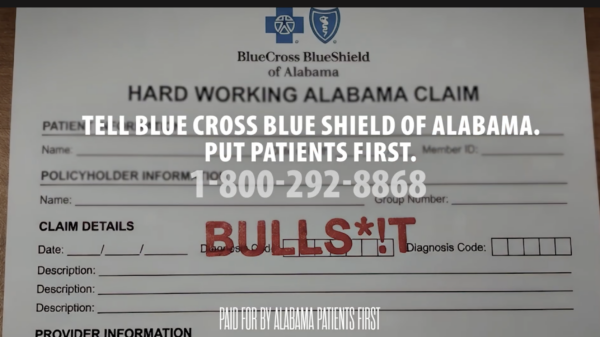

While restructuring under those terms, Jackson Hospital has filed a lawsuit against Blue Cross and Blue Shield of Alabama, alleging that reimbursement practices by the insurer contributed to the hospital’s financial distress. The complaint, filed in bankruptcy court, seeks injunctive relief and monetary damages.

Blue Cross has denied the allegations. In a statement, Sophie Martin, director of corporate communications and community relations for Blue Cross and Blue Shield of Alabama, said the insurer has negotiated fairly with the hospital and rejected the claims made in the lawsuit.

“Although balancing the needs of our customers and our hospitals is always challenging, Blue Cross has negotiated with Jackson Hospital fairly,” Martin said. “Remember that Blue Cross customers only make up approximately 25 percent of Jackson’s patients, while the lawsuit filed by Jackson Investment Group and their Texas lawyers tries to shift most of the costs of the hospital’s shortfall onto the backs of our customers. That is unacceptable. The claims that Jackson Investment Group brought against Blue Cross and Blue Shield of Alabama are entirely without merit.”

APR was unable to reach Jackson Hospital or Jackson Investment Group for comment.

Any recovery from the lawsuit, however, would first be applied to repayment of the debtor-in-possession loan, according to bankruptcy court filings. The outcome of the litigation and the hospital’s ability to meet restructuring deadlines will determine whether Jackson Hospital can emerge from bankruptcy as an independent facility.