By Susan Britt

Alabama Political Reporter

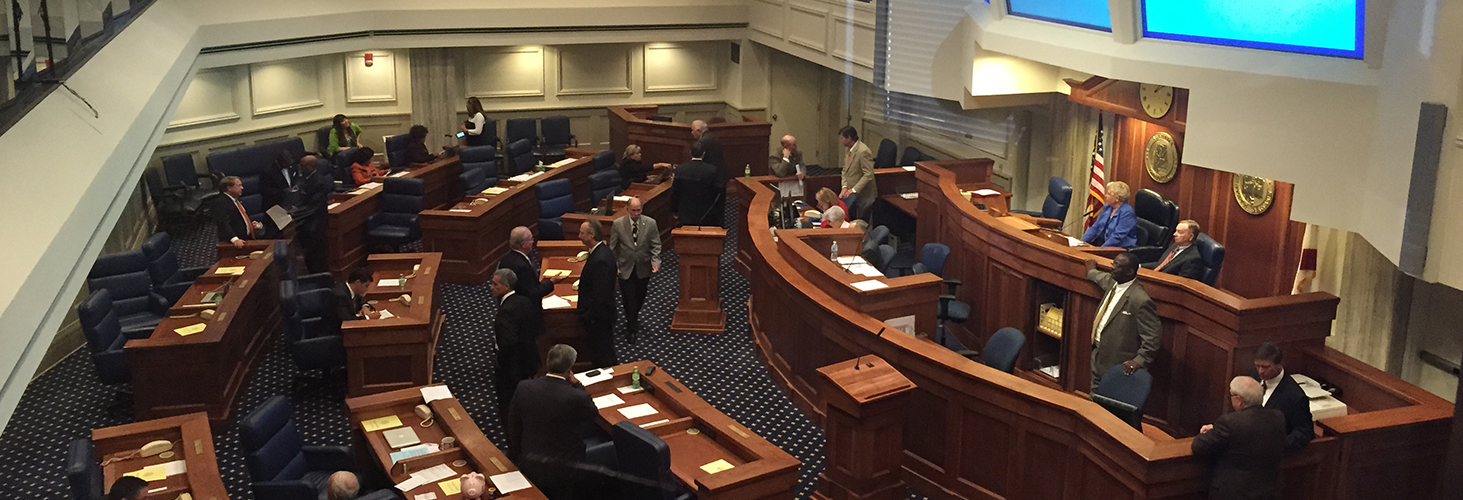

MONTGOMERY—The Alabama Senate met on Monday after being called into Special Session by Gov. Robert Bentley. The session was opened, a bill was passed notifying the Governor that the Senate was in session, a few bills were filed, and then, they voted to recess until August 3. All of this occurred in just over 19 minutes.

President Pro Tem Del Marsh (R-Anniston) addressed the body saying that, with no disrespect to the Governor, they were simply not ready to be in session. “We expected to be back in mid-August. We have been working hard since the Session ended, since the Governor vetoed the last budget, our goal was to come back, be ready by August 7, and we did that because we figured the Governor bring us back in the middle of August.”

Marsh continued, “What happened today is, all we are saying is, let’s stay on our schedule. We want to have enough time to get the bills passed. Backing it up to August 3 gives our [study groups] time to work and do the things we have been doing to have a solution to the General Fund problems…It is in no way in disrespect to the Governor. It would be chaotic to come back in now when we are not prepared, because the groups haven’t finished their work.”

Marsh said he felt that the appetite for raising taxes had not changed since the Senate had adjourned. He said that the group discussions were more geared toward changing the tax structure, and moving funding between budgets.

He said that since the General Fund had a “lack luster” growth over the last several years, “the last thing you want to do is increase taxes. So, we are not in the mood to do that. We need to be looking at things like the flat tax. You look at states that have an income tax and have gone to a flat tax they have had better economic growth because it is an incentive for your economy to have a simplified tax code. We have got to look at ways to spur this economy and grow our way out of this and not tax our way out of it.”

Marsh said the proposal would lower income taxes down to about three percent and remove the deductions more leveling the field for taxpayers.

Another proposal coming from the study groups and others, is to move the Use Tax from the Education Trust Fund to the General Fund.

“I am fine with moving the Use Tax over to the General Fund to give it some growth over time. But, I think the obligation needs to move with that. It will be a plus side to the General Fund, and it gives them the growth,” said Marsh.

Senate Minority Leader Quinton Ross (D-Montgomery) disagreed saying, “Making the Education Trust Fund broke is not going to help the General Fund, so we have to be very careful drafting any kind of legislation that has the ability to take money away from the ETF.”

According to Marsh, the gaming bill is still very much alive, although now, it is a separate issue from the budget.

“The gaming legislation which I have introduced again has nothing to do with the General Fund problem. Those are two separate issues,” said Marsh. He said the current debate was, should the State be receiving revenue from gaming, since gaming already exists.

Marsh stated that he had introduced his gaming proposal once again, but that he had made some changes. The Gaming Commission positions have been increased from five to seven. Appointments to the Commission will be taken out of the hands of the Legislature, giving the appointing power to associations like the members of the Sheriff’s and Hospitality Commissions, and others with interest in the business model.

The new gaming bill also switches the lottery proceeds from the General Fund to the Education Trust Fund.

Ross said, “We need as many ideas on the table and one of the ideas, in my mind, for long-term solutions would be the gaming issue.”

Another issue to be proposed is changing the Business Privilege tax. Marsh said they are trying to find a way to exempt small businesses.

“We are looking at the Business Privilege tax and finding a way to make those small businesses exempt from that tax, because that is where most of your job creation comes from, and it is cumbersome for them to have to deal with,” he said.

It appears that there are other proposals in these study groups, as there are other solutions to the budget problem; but Marsh was not ready to discuss them. He said, “I want to make sure that report is finished before I start talking about the components of it.”

A joint budget meeting immediately followed the recess in chambers. The Senate is scheduled to reconvene on August 3 at 5:00 p.m.