By Brandon Moseley

Alabama Political Reporter

Republicans have always believed in lowering taxes and cutting government’s role at all levels in our lives…until they stopped believing in it. How do Republican legislators defend their votes to increase taxes in a conservative State, when they were elected just ten months ago promising to never raise taxes, and to make state government live within its means.

State Representative Mac McCutcheon (R-Capshaw) said in a statement on Facebook, “These are difficult times for the State. We must continue to work in Montgomery for a solution. I respect my colleagues and their opinions on taxes. Whether they are for or against I will not be one who makes my case by criticizing their opinion and vote. I am concerned about budget cuts and budget reform vs. State services being cut.”

State Representative Mac McCutcheon (R-Capshaw) said in a statement on Facebook, “These are difficult times for the State. We must continue to work in Montgomery for a solution. I respect my colleagues and their opinions on taxes. Whether they are for or against I will not be one who makes my case by criticizing their opinion and vote. I am concerned about budget cuts and budget reform vs. State services being cut.”

Rep. Kile South (R-Fayette) said on Facebook, “I was elected to go to Montgomery to make the difficult decisions that I think are best for the people of District 16, and this week was the first major test in my opinion. While not everyone will have the same opinion as mine I did what I thought needed to be done no matter how tough. Although I dislike taxes as much as the next person, there are certain functions of state government that I find very important to the people of the District. I will own each vote that took this week, and don’t mind explaining as to why.”

House Ways & Means Committee Chairman Steve Clouse (R-Ozark) said on Facebook, “Representative South’s explanation of the revenue raising measures are right on target. This is a terrible year for all legislators, but particularly freshman legislators like Representative South. We need more legislators like Representative South who will delve into the issues instead of saying no is the answer to everything. No has gotten us in the situation we are in now. I too, want to say thank you to Kyle South for his service to his district.”

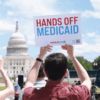

Rep. South continued, “Nursing Home Provider Fee- Same as above…the nursing home would pay to Medicaid an extra $400 per bed in order for Medicaid to use as matching funds. The Nursing Home is actually reimbursed the $400 and the patient doesn’t see an increase. Again will raise $8 million annually. Both of these were agreed to by the industries and will sunset in 2 Years.”

Rep. McCutcheon said, “I know there are cuts to be made but I also know that the bureaucrats who make the final decision to cut the agency services will make the cuts on the lower levels. WE HAVE HEARD THE THREATS!! This will hurt the people I serve.”

Rep. South wrote, “Medicaid Provider Fee for Pharmacies- Pharmacies now pay a 10 cent provider fee for each prescription. This bill would require them to now pay a 25 cent provider fee. Currently providers receive $10.40 per as a dispensing fee this would raise that to $13.90 for a gain of $3.50. This $3.50 is allowed to be used as matching funds in order to draw down more federal dollars. The consumer actually sees no increase in the amount of their prescription and the pharmacy sees no loss unless they do less than 8% in Medicaid prescriptions, which very few in the state do and none in our area. Raises $8 million annually.”

Rep. McCutcheon said, “We need reform, I have resurrected an accountability oversight bill to try and fix some budgeting problems but got criticized in al.com for trying to support corruption in Montgomery. This is a bill we need to pass but it will take a lot of work due to it’s history.”

Rep. South continued, “Cigarette Tax- This was put into the budget as a conditional $66 million appropriation to Medicaid. A $66 million cut would be devastating to rural healthcare & hospitals, and would equate to approx. $150 million after it’s matched by the feds. Our hospital would be crippled by such a cut. My main focus was to find a means to level fund Medicaid off of the prior year.”

Rep. Alan Harper (R-Northport) said, “Representative South did a great job of explaining several of the issues/votes taken this week. Please read and understand these measures. Thank you Rep. South for your commitment to your district and the great State of Alabama.”

Rep. South continued, “Car Title Fee- The car title fee currently is $15 and this would raise it to $28. This fee hasn’t been raised since the mid 1980’s, and you pay it once so long as you own your vehicle.”

South continued, “Gas Tax- This came to a committee that I serve on, and we were asked to let it get to the floor for debate. During the last two days, I have worked diligently to get this thing under wraps. It started at a 46 cent ceiling over the next 15 years, but is now being considered as a 5 cent increase with an 11 cent cap. This money would be going to the Road & Bridge fund only for the use to pave and construct highway infrastructure (45 percent of the funds would be passed along to the cities/counties for the same purposes). Even with the new maximums set I don’t feel I can support it without a vote of the people.”

Rep. McCutcheon said, “We have only a few days left to get a GF Budget to the Governor. I will support some new tax measures to insure that State services will continue. I will commit the next three years of my term to budget reform measures, of which we need. I will continue to work on the bill to create a Committee to work year round on agency spending not just during the Leg. Session. We also must take a serious look at earmarks. My decisions are not dictated by political re-election they are influenced by listening to the concerns of the people and knowing all the facts. I have been labeled as falling into corruption, being a rino and a idiot! But at the end of the day I must lay my head down and know I did the best I could for everyone that I represent!”

Despite the $104 million in tax increases and an Education Trust Fund raid there is still not enough money in the House budget to level fund the state general fund (SGF).

Rep. South concluded, “Still with all of these revenue increases we will still see cuts to this year’s budget. In total we will cut approx. 3 percent of total expenditures from last year’s General Fund budget. I believe my votes prioritize Healthcare and Senior Citizens, while protecting our education dollars. Some agencies will see cuts as much as 8 percent!! Please don’t assume that I think we have cut enough because there are still places that gov’t needs to be scaled back. I understand that many people feel TAX is a four letter word, and I don’t question your stance but I felt like I needed state mine. I value everyone’s input so please feel free to share your thoughts!!!”

State Representative Mack Butler (R-Rainbow City) said in a statement, “In the budget we are proposing there is specific language to protect our clerk’s offices and driver’s license offices. Cuts are coming as we have to live within our expected revenues. We passed a few revenue measures that will provide for Medicaid and prison funding. Everything else will see some cuts. Just FYI.”

A proposed business privilege tax increase, a porn and gentleman’s club tax, and an increase in the auto rental/lease tax passed out of Chairman Clouse’s committee; but ran into a buzzsaw of opposition on the House floor. The Senate will undoubtedly make a number of changes to the Clouse budget (HB 1) when they deal with it this week. It will then come back to the House.