By Brandon Moseley

Alabama Political Reporter

Thursday, the Alabama Democratic Party released a statement critical of the recently released House GOP tax plan that passed the U.S. House of Representatives earlier that day.

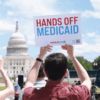

“House Republicans voted today to increase taxes on middle class families and provide massive giveaways to billionaires and wealthy corporations. While Senate Republicans debate their tax plan in committee, the latest edition calls for permanent tax breaks for the richest, paid for by cutting health care and other programs Social Security, Medicare, Medicaid, and education that working Alabama families rely on every day,” the Alabama Democratic Party wrote.

The Alabama Democratic Party claims that, “The Republican tax plan is a bad deal for millions of working families across the country who will be will be worse off under this bill than if Congress had done nothing. On top of permanently raising taxes on millions of Americans, the Republican tax bill will cost American jobs by incentivizing big corporations to move American jobs overseas and making it harder for small businesses on Main Street to compete. It’s long-past time for Republicans to get serious about actual tax reform and join Democrats in building an economy that works for everyone.”

Specifically, the Democrats cite: the repeal of a tax credit for teachers who buy their own school supplies; the repeal of the student loan interest deduction; the repeal of the medical expense deduction; a $25 billion cut to Medicare; claim the plan incentivizes large companies to move jobs overseas; the repeal of the state and local income tax deduction; claim that the richest one percent of Alabama taxpayers will receive 48 percent of the tax cuts; claim that 25 percent of middle-income taxpayers in Alabama would even see their taxes go up by $620 on average; would raise health care insurance premiums on middle-class families; claim the tax bill sabotages the health care system by repealing the individual mandate; cuts corporate income taxes; ends the New Market Tax Credits program; phases out popular tax credits for wind and solar energy; and eliminates a critical infrastructure financing measure designed to help states rebuild after sudden events.

Congresswoman Terri Sewell, D-Selma, urged Congress, “To reject this misguided and mean spirited tax bill that is being rushed through this Congress today. Mr. Speaker this Republican sham tax bill picks winners and losers. The winners under this tax bill are corporations, Wall Street fat cats, the one percent of the highest wage earners in America and the special interests. The losers are the middle class, working families, students and the most vulnerable in our society, our farmers. I would like to submit a letter for the Record, Mr. Speaker, a letter from the national farmers union which objects to this bill. These are the very same people that this President promised to benefit. This is what this tax bill does for corporate America. It dramatically cuts rates for the largest companies in the world moving the corporate tax rate from 35 percent to 20 percent. It creates loop holes for wealthy individuals to characterize their wage income as small business income so they can pay less taxes. It repeals the alternative minimum tax which captures a tax liability for wealthy individuals. The only tax return for Mr. Trump we have seen he had to pay $38 million. Why? because of AMT. This tax bill would also permanently repeal the estate tax which only affects 5,500 households in America, and I can tell you Mr. Speaker that none of those households are in my district. This is not comprehensive tax reform. We can do better.”

The plan, HR1, passed the House and goes to the Senate where the Senate claims that they are working on their own plan.