By Chip Brownlee

Alabama Political Reporter

The Alabama Senate approved a small income tax break Thursday.

Part of the Republican agenda, the break would increase the adjusted gross income range for the largest standard income tax deduction, meaning some families will have a smaller tax burden next year.

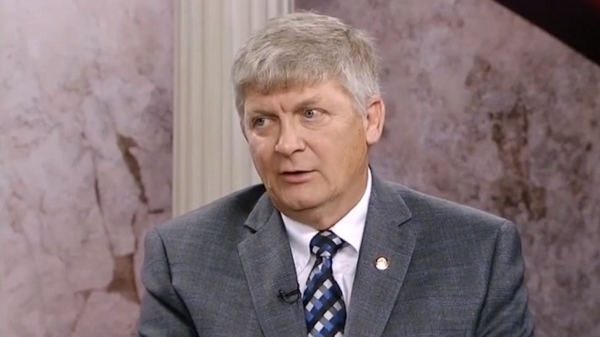

“We finally have some dollars to deal with the needs of the state,” said President Pro Tem Del Marsh, R-Anniston, who sponsored the tax cut. “The working class men and women of this state will benefit. No high-income benefit from this. It’s all strictly working people of the state of Alabama.”

The tax cut is small in scope, as Marsh noted on the floor Thursday, but it received a unanimous 28-0 vote. A Legislative Fiscal Office analysis of the legislation showed the bill would only reduce tax collections by an estimated $4 million but would affect about 200,000 tax filings.

It’s the the first state income tax cut since 2006, Marsh said.

Alabama’s standard income tax deduction is different for individuals depending on their filing status and income, and it decreases the tax burden for low-income filers, as a portion of income, to a larger degree than those of higher incomes.

Above a certain income level, the deduction falls steadily until it hits either a $4,000 minimum for those who file joint tax returns or $2,000 for those who file individually.

Current tax law allows those making up to $20,499 and filing jointly to deduct $7,500 from their taxable income. The new bill would expand the maximum income that allows for the largest deduction from $20,499 to $23,000, allowing a larger segment of the population to utilize the largest deduction.

The standard deduction then decreases by $175 for every $500 of additional income until the minimum standard deduction of $4,000 is reached.

For those making over $6,000 a year, Alabama’s income tax rate is 5 percent.

The $4 million fiscal note is only a small portion of this year’s estimated $6.6 billion education budget, which is largely funded by the income tax. The tax cut is one of many proposals made possible this year by an improving economy and increased tax receipts.

“We’re going to continue to be fiscally responsible and create a better economy and when that economy grows and we can give back, we want to do that,” Marsh said.