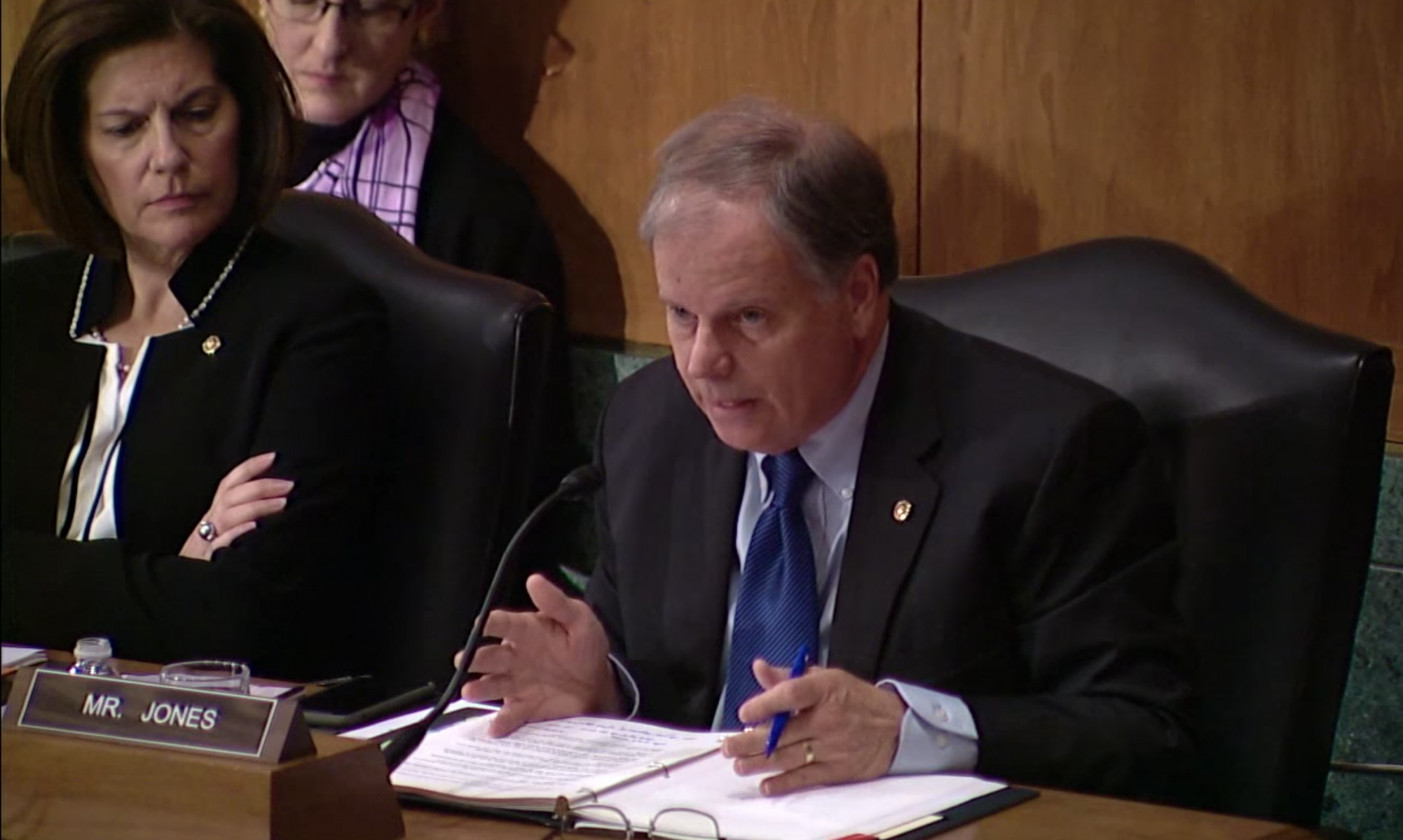

U.S. Sen. Doug Jones, D-Alabama, hosted a press conference at the Birmingham International Airport to celebrate the U.S. House of Representatives’ vote to eliminate the Military Widow’s Tax.

Jones’s legislation to end the tax was included in the National Defense Authorization Act that was passed by the U.S. House last week.

The elimination of the penalty impacted an estimated 2,000 surviving military spouses in the state alone.

The bill has passed in the House of Representatives and a final vote in the Senate will take place early this week, where it is expected to pass with broad bipartisan support.

“For nearly four decades, the military widow’s tax has hurt our Gold Star families,” Jones said. “Today, we are one BIG step closer to finally repealing this unjust law and fulfilling our commitment to the military families who have sacrificed so much.”

The move had broad bipartisan support.

Congressman Mo Brooks, R-Huntsville, said, “The FY20 NDAA House-Senate compromise bill improves the quality of life of America’s service members by: giving troops a 3.1% pay raise; phasing out the Widow’s Tax; addressing the military housing crisis and requiring the services to establish a Tenant Bill of Rights; and, doubling the reimbursement amount for state licensure expenses for military spouses, who face unique career challenges when they move across state lines and often must pay substantial sums to requalify for nearly identical licenses.”

Congressman Bradley Byrne, R-Montrose, said, “Importantly, this bill gives our troops a 3.1 percent pay raise, the largest increase in a decade, and repeals the widow’s tax, a goal I’ve worked towards for many years.”

Congresswoman Terri A Sewell, D-Selma, said, “We delivered a smart, bipartisan defense bill that improves campaign election security, makes good on our promises to military widows and authorizes funding to equip, supply and train U.S. troops and support military families at home and abroad.”

Also participating in the press conference in the press conference with Jones were retired General Charles Krulak, the 31st Commandant of the U.S. Marine Corps; Anne Hartline with the Military Officers Association of America Surviving Spouse Advisory Committee; and surviving military spouses Carrie Cunningham, Stella Malone, and Donna Martin.

Jones’ legislation, the Military Widow’s Tax Elimination Act, will repeal the law that prevents as many as 67,000 surviving military spouses nationwide from receiving their full Department of Defense and Veterans Affairs survivor benefits. Currently, military widows and widowers who qualify for the VA’s Dependency and Indemnity Compensation (DIC) are forced to take a dollar-for-dollar offset from the Survivors Benefits Plan (SBP) benefit, even though their retired spouses elected to pay into the program.

Legislation to repeal the widow’s tax has been repeatedly introduced in the Senate for nearly two decades. Under Senator Jones’ leadership, the bill appears poised to pass and then be signed by President Donald J. Trump (R).

Jones introduced the bill with Republican Senator Susan Collins of Maine in March.