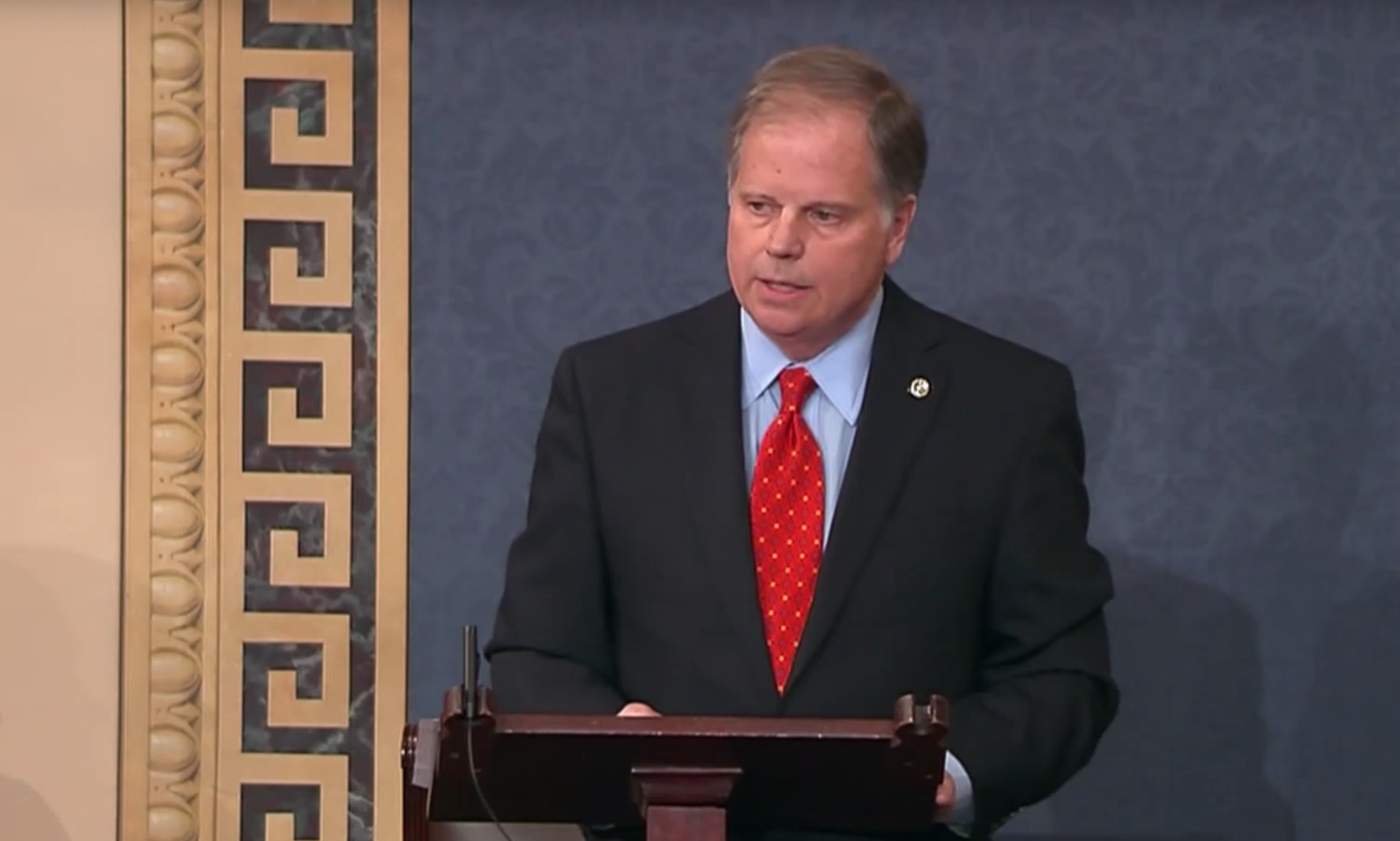

Sen. Doug Jones, D-Alabama, is advocating for a plan to give small businesses another round of help in paying employees by using the services of payroll processors. The plan to help aid small businesses was featured in The New York Times Monday.

Several lawmakers have become frustrated with banks delivering aid to businesses during the coronavirus economic crisis and have begun exploring ways to sidestep the banks to deliver aid.

One of these proposals is using Internal Revenue Service records and payroll processing companies, as well as the Federal Reserve, to help distribute money more swiftly.

Jones is advocating for using the processors, which already distribute wages for close to 40 percent of U.S. businesses. And companies that don’t use payroll processors could get payouts directly from the I.R.S.

“Another option makes it easier and takes a little pressure off the banks,” Jones told The New York Times. “They’ve been overwhelmed.”

Jones had urged fellow lawmakers to consider using payroll companies rather than banks when the first installment of the Payroll Protection Program was taking shape.

The CARES Act included stimulus checks, a $660 billion package for small businesses and enhanced unemployment benefits. The PPP quickly ran out of money and had to be replenished last month.

Some banks withheld stimulus cash from people with overdrawn accounts and some banks’ debit cards, used to distribute unemployment benefits, didn’t work properly.

This has frustrated some lawmakers.

Jones has joined his colleagues Sens. Mark Warner of Virginia, Bernie Sanders of Vermont and Richard Blumenthal of Connecticut in proposing a “Paycheck Security” grant program to cover the wages and benefits of employees of affected businesses and non-profits until the economic and public health crisis is resolved.

Jones has said securing wages and benefits for workers is imperative to ensure public health, too, by giving people the security they need to stay home and avoid spreading the virus.

Several publicly traded companies — notably Ruth’s Chris Steak House and the Los Angeles Lakers — were able to get PPP loans due to their close working relationships with banks while small businesses were still in the application process when the PPP ran out of money the first time.

Both the Lakers and Ruth’s Chris Steak House have since returned the money.

“We’re hoping that it’s really going to get better now that Ruth’s Chris isn’t supposed to be front and center,” said Sen. Ron Wyden, D-Oregon. “But it’s still going through a set of banking channels.”

There is some skepticism of taking the PPP from banks.

“We need to look at the programs that are out there, and tweak them to get them to work better,” said Sen. Rob Portman, R-Ohio. “I would hate to take it away from banks and try something else that we haven’t tried yet.”

Jones is seeking re-election later this year. Former Sen. Jeff Session and former Auburn head football coach Tommy Tuberville are both running for the GOP nomination in the Republican primary runoff in July.