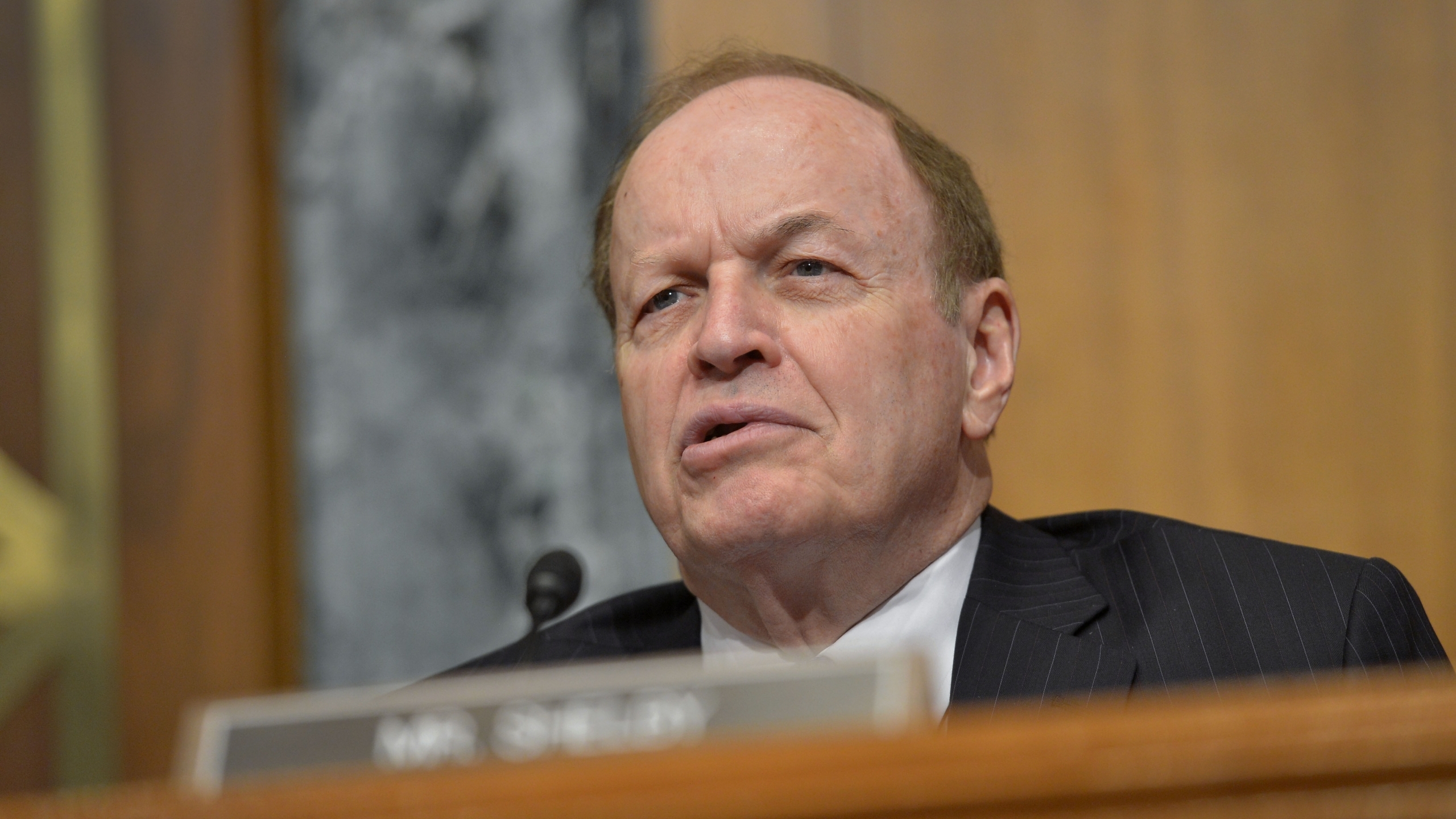

Senator Richard Shelby, R-Alabama, last week highlighted his concerns regarding the risk of rising inflation to Federal Reserve Chairman Jerome Powell during a Banking Committee hearing on the Federal Reserve’s Semiannual Monetary Policy Report to Congress.

“In the midst of the largest increase in consumer prices in 13 years, the Biden administration is proposing trillions more in government spending,” Shelby said. “Additional wasteful spending will only further intensify the current inflationary risks. The dual mandate of the Federal Reserve is to achieve both price stability and maximum employment. The Fed’s ability to maintain price stability is threatened by actual inflation or the expectation of inflation. It is my hope that, in carrying out its mandate, the Federal Reserve will recognize the current and future risk of rising inflation before it is too late.”

The senator went on to question Powell about whether he holds the same concerns, to which Powell noted that we are experiencing an uptick in inflation and that the Federal Reserve is watching that closely and will react accordingly.

“Chair Powell, welcome and thank you for coming before the committee today,” Shelby said. “When you were last here, I raised concerns about the risk of rising inflation, particularly following the enactment of a $2 trillion spending bill earlier this year. Since that time, the threat of rising inflation has worsened. In June, U.S. inflation accelerated at its fastest pace in 13 years. Consumer prices increased by 5.4 percent from a year ago, which is the largest 12 month jump since 2008. Americans are now paying higher prices for many of the goods and services they cannot do without.”

“The buying power of the dollar has diminished over the past forty years,” Shelby said. “According to the Bureau of Labor’s Consumer Price Index, one dollar today is seven times less valuable than it was in 1970; three and a half times less valuable than in 1980; half as valuable as in 1990; and one and a half times less valuable than in 2000.”

“Recently, the price of commodities has increased swiftly,” Shelby said. “In the span of one year, price increases have affected numerous areas of our economy. The price of agricultural goods has increased: corn by 50 percent; wheat by 17 percent; soybeans by 54 percent. The price of metals has risen: copper has increased by 43 percent; aluminum has increased by 47 percent. Energy prices have grown: the price of crude oil has increased by 70 percent; gas prices are up 45 percent. In the automotive industry, prices for used cars rose 45 percent in the past year, 10.5 percent in June alone. Airline tickets are up 25 percent. The cost of milk is up 7.5 percent. As the cost of everyday items are on the rise, Americans are concerned about inflation and its effect on our economy.”

“To this point, the Biden administration continues to claim that the increases in inflation are temporary,” Shelby said. “I, along with many others, believe that this could be a sign of things to come. For instance, economists surveyed by the Wall Street Journal this month forecasted higher inflation for the next couple of years.”

“Throughout the 1970’s, high inflation crippled consumers with rapid and sudden price increases,” Shelby said. “Many of the same conditions then, such as loose monetary policy and significant government spending, are present in our economy today. If we fail to take this inflation risk seriously, I am concerned that our nation could be faced with the same challenges of years ago.

Sen. Tommy Tuberville, R-Alabama, expressed similar concerns in a speech on the Senate floor on Thursday.

“This is what folks back in Alabama were talking about – they were talking about small businesses that can’t find people to work, because the government is paying more in unemployment benefits than folks can make on the job,” Tuberville said. “They were talking about an economy that’s hurting – really hurting – hardworking Americans. “They were talking about the real costs of rising inflation [and the] rising prices on goods and services. And by the way, in June, consumer prices increased 5.4 percent.”

“Altogether, President Biden has called for 30 – let me repeat that, 30 – different tax increases on the American people that total over $3 trillion,” Tuberville said. “President Biden wants to raise the corporate rate from 21 to 28 percent. That was lowered just a couple of years ago [and] that put money in people’s pockets all across the country.”

“We’re looking at a package in the next few weeks that’s going to be $3.5 – or possibly even more – trillion dollars,” Tuberville said. “That’s unfathomable to me. Just remember that what you earn, grow, and work hard to preserve is your money – it is your money – not the government’s.”

Shelby is a former chairman of the Senate Banking Committee.