Congresswoman Terri Sewell, D-Alabama, on Wednesday voted to pass the Build Back Better Act out of the House Ways and Means Committee. The $3.5 trillion budget reconciliation package passed out of committee following nearly 40 hours of debate. Sewell was able to secure the inclusion of several of her own bills in the omnibus spending package.

“President Biden and Congressional Democrats’ transformational Build Back Better agenda is about leveling the playing field for working families and growing our economy from the bottom up and middle out,” Sewell said. “With this bill, we are cutting taxes for middle-class Americans and small businesses, expanding access to child care and healthcare, lowering prescription drug costs, and addressing the growing threat of climate change and environmental injustice. Its historic investments will uplift Alabamians who have been left behind and put us on a path to a more prosperous and equitable future.”

The Ways and Means Committee’s portion of the Build Back Better Act includes measures to:

- Extend the American Rescue Plan expansion of the Child Tax Credit and make permanent the American Rescue Plan expansions of the Earned Income Tax Credit and the child and dependent care tax credit

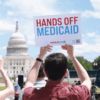

- Provide immediate coverage for Americans in the Medicaid coverage gap

- Extends the American Rescue Plan’s expanded premium tax credits to help lower health insurance costs

- Expanding Medicare coverage to include dental, vision, and hearing benefits

- Lowers prescription costs for Americans by allowing the HHS Secretary to negotiate for lower drug prices

- Makes the tax system more progressive by raising the tax rate for high-earners, raising the top capital gains rate, and creating an additional surtax above the current highest rate for the highest-income taxpayers

- Cuts taxes for our nation’s smallest businesses and raises the corporate rate to 26.5 percent

- Promote global competitiveness while ensuring that multinational corporations pay their fair share by better harmonizing the U.S. corporate minimum tax rate with the rate agreed to by over 130 countries in international negotiations

- Equips the Internal Revenue Service with updated technology and additional staffing needed for the complex audits of high-wealth individuals

- Supports clean energy investment and deployment and the creation of good, well-paying jobs

- Reinstates Build America Bonds and advanced refunding bonds to provide financing to state and local governments and spur investment in the private sector

- Expands proven tax credit programs that encourage economic and affordable housing investments in communities that are most in need

Sponsors of the legislation say the spending bill expands workplace supports by:

- Providing up to 12 weeks of universal paid family and medical leave for all U.S. workers

- Reauthorizes the Health Profession Opportunity Grant (HPOG) program to strengthen this effective health care job training program and makes it available nationwide

- Invests in childcare access and equity by ensuring that parents and caregivers have the most useful and up-to-date information on available child care options and helping them easily apply for slots

- Funds the construction and remodeling of child care facilities to make them even safer and more aligned with public health guidelines

- Raising the wages of child care workers, who currently earn a median wage of $12.24 per hour and often live in poverty.

Sponsors say the bill strengthens retirement security by:

- Requiring employers without employer-sponsored retirement plans to automatically enroll their employees in IRAs or 401(k)-type plans

- Makes the Saver’s Credit refundable so that those without any income tax liability are eligible to receive the benefit in the form of a contribution to their retirement account.

Sponsors say that the package protects the elderly and people with disabilities in nursing homes by:

- Funding elder justice programs that increase support for state and local Adult Protective Services offices and long-term care ombudsman programs

- Addresses the staffing shortages in long-term care facilities by providing funds for recruitment and retention, including wage subsidies, access to child care, tuition reimbursement, and student loan replacement.

- Improves the accuracy and reliability of the data collected in these facilities to increase transparency for patients and their families

- strengthen the federal understanding of care quality and reimbursement, and study and update staffing – a key predictor of quality and safety.

Sponsors say that the bill modernizes and reforms the Trade Adjustment Assistance (TAA) program by:

- Increasing benefits and expanding eligibility to meet the needs of today’s workers under TAA for Workers program

- Reestablishes the TAA for Communities program to target support and initiate proactive outreach in trade-affected communities

- Delivers additional funding to the TAA for Community Colleges and Career Training program to better support students served by community colleges

- Expands eligibility, improving outreach, and increasing funding for TAA for Firms to assist firms facing competition from abroad

- Improves outreach and increasing benefits for TAA for Farmers, which hasn’t received new funding in a decade.

Sewell secured the inclusion of several of her own bills in the Build Back Better Act including:

- The Rural Health Training Opportunities Act – Expands the health profession opportunity grant program that provides education and training to low-income individuals for high-demand occupations in the healthcare field.

- Local Infrastructure Financing Tool (LIFT) Act – Provides a number of flexible financing tools that meet the unique needs of communities across the country, including transportation, public health facilities, schools, and other infrastructure and economic development projects. It will restore the ability of states and localities to refinance existing debt through advance refunding, a tool that Republicans gutted in their 2017 tax bill.

- New Markets Tax Credit Extension Act – This bill will once and for all make the successful New Markets Tax program permanent. The proposal provides: an additional $2 billion (for a total of $7 billion) in 2022 and $1 billion (for a total of $6 billion) in 2023. From then forward, it sets the allocation amounts at $5 billion for 2024 and all years thereafter.

The bill still has to pass on the House floor and in the Senate where key swing Sen. Joe Manchin, D-West Virginia, has publicly called for decreasing the package to $1 to $1.5 trillion.

Sewell is in her sixth term representing Alabama’s 7th Congressional District – Alabama’s only majority-minority district.