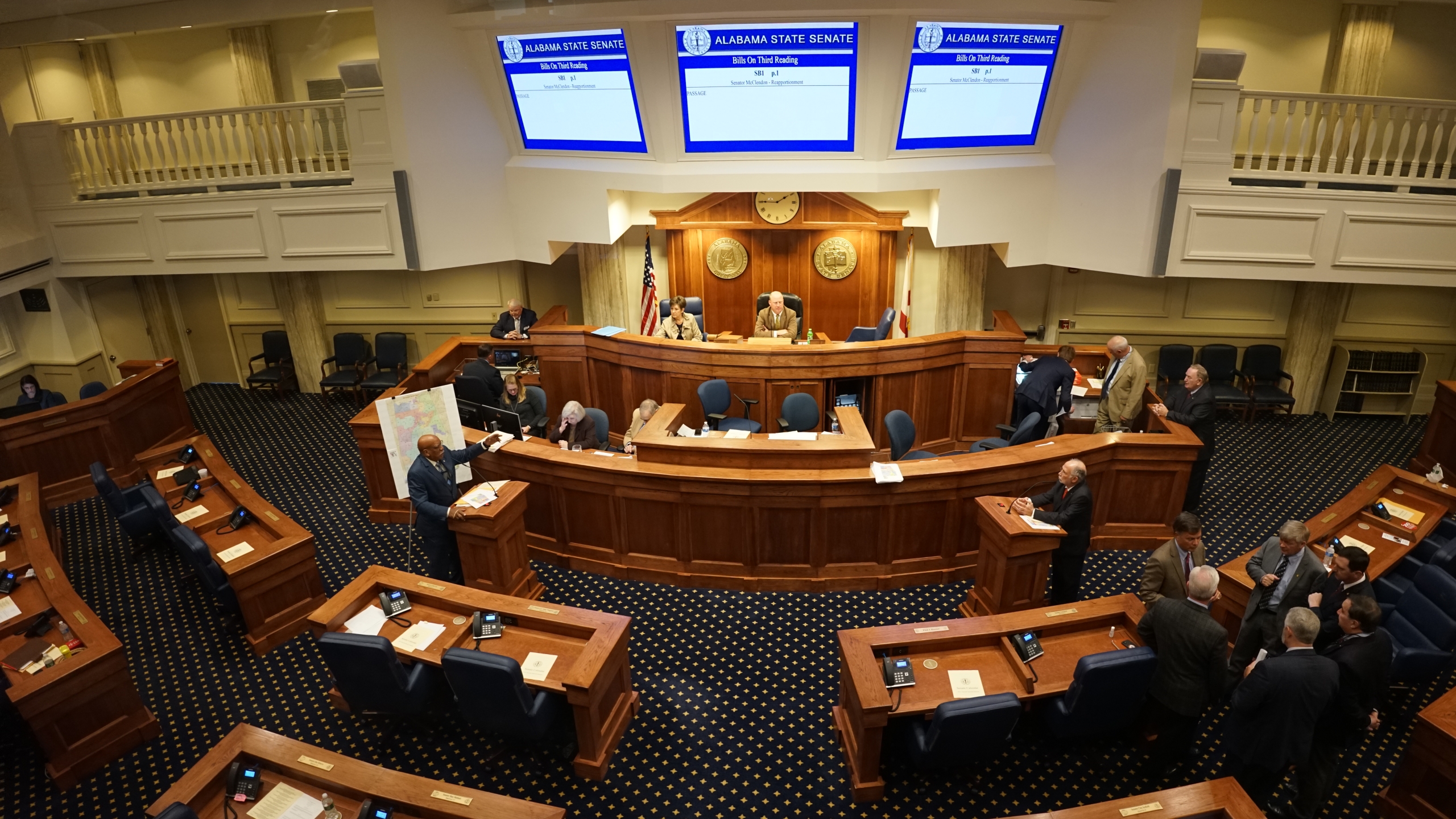

Following a 31-0 vote on Thursday, the Senate passed a bill that would repeal the tax on overtime pay up to a certain amount. The House concurred and now the bill awaits Gov. Kay Ivey’s signature to become law.

The approved version of HB217, sponsored by Rep. Anthony Daniels, D-Huntsville, will put a cumulative $25 million cap on the overtime tax break annually. A sunset provision would end the tax cut on Jan. 1, 2027, unless lawmakers extended or made the law permanent.

“I think we’re at a time in our economy we need a lot of participating in the labor force and try to motivate that extra work and rewarding them for that,” Sen. Sam Givhan said during the Senate debate on the bill.

Givhan helped carry the bill in the Senate.

The legislation is different from the original bill, which permanently ended the tax on overtime pay. The compromise came after Education Trust Fund Chairman Arthur Orr believed the legislation would negatively impact the ETF budget.

On Wednesday, Orr introduced an amendment that would cap the tax cut on overtime pay on the first $2,000 made per individual worker. However, over the course of one day, Orr retracted his sentiments and accepted the bill’s final form.

Austal USA, The Business Council of Alabama, the Hospital Association, and workers’ unions all supported the original legislation, according to reporting by APR.

Sources close to the deal-making who asked to speak anonymously about the internal negotiation stated that Orr’s stance changed due to Austal’s support for the legislation.

The bill is expected to help both businesses and workers.