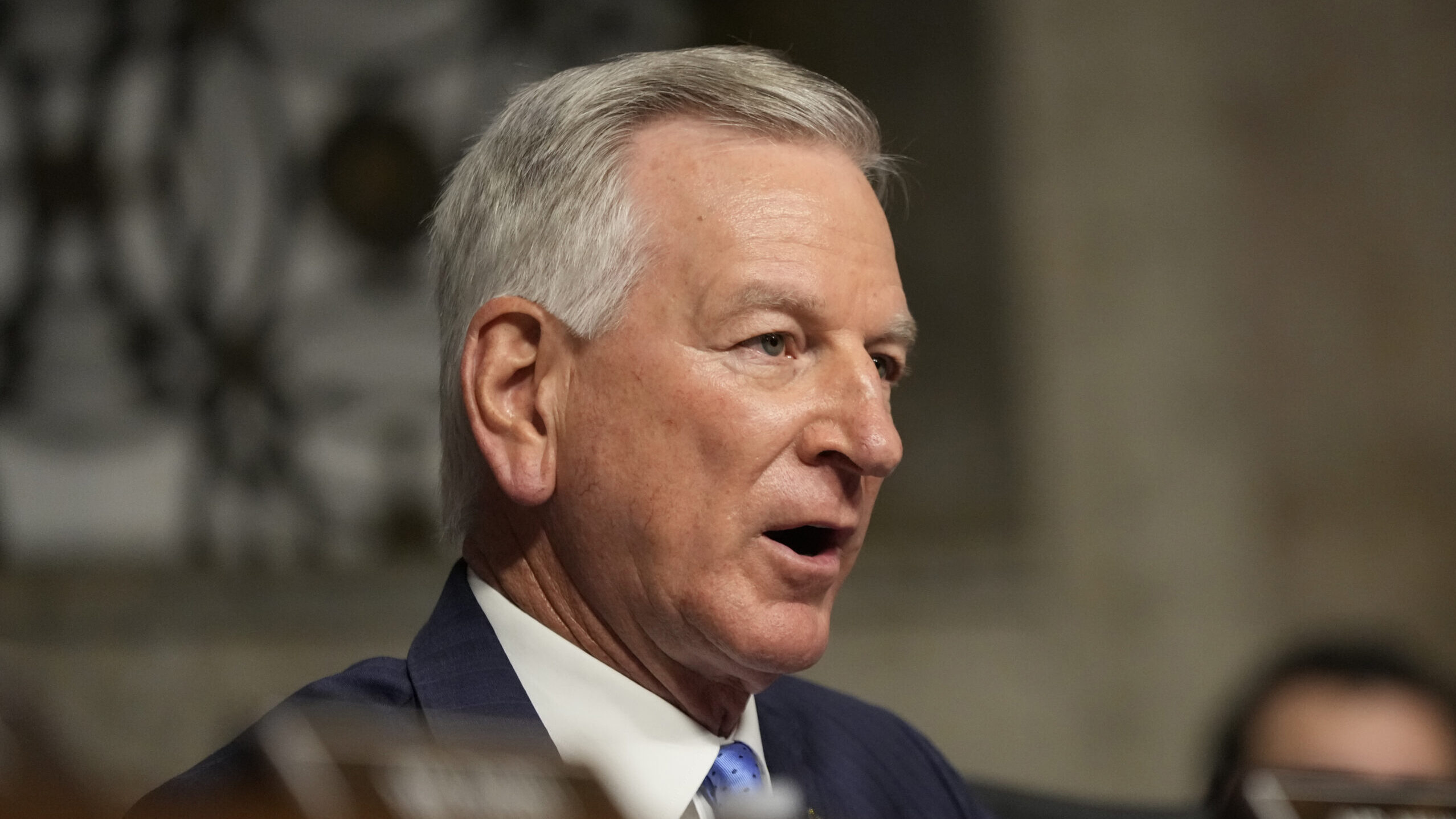

U.S. Sen. Tommy Tuberville, R-AL, recently joined U.S. Sen. Todd Young, R-IN, in introducing the American Innovation and Jobs Act, a piece of legislation focused on expanding research and development (R&D) tax deductions for small businesses and startups in the U.S.

An official press release from Tuberville regarding the legislation claims that the bill would “help America outcompete and out-innovate global rivals, like China, who are significantly investing in research and development.”

Specifically, the American Innovation and Jobs Act would reverse a provision from the Tax Cuts and Jobs Act — passed under the first Trump administration in 2017 — which mandates that tax deductions for R&D costs be spread out over multiple years. In repealing that provision, the American Innovation and Jobs Act would allow businesses to fully deduct R&D expenses each year.

The legislation would also immediately double the refundable R&D tax credit cap from $250,000 to $500,000 before ultimately tripling the size of the cap to $750,000 over the course of ten years.

Additionally, the bill would expand access to that credit by increasing its eligibility threshold “from $5 million to $15 million in gross receipts” and by extending “the period during which startups can claim the credit from 5 years to 8 years after beginning to generate at least $25,000 in revenue,” according to Tuberville’s press release.

“China is on the move and would love nothing more than to make American innovation a thing of the past,” Tuberville said of the legislation. “Thankfully, President Trump is 100 percent committed to doing whatever it takes to put American businesses first on the world stage. This bill gives us the upper hand over China by investing in research and development projects based in the United States.”

According to Akusti Leino, a Federal Tax Policy Fellow at the Tax Foundation, expanding R&D funding and access to the R&D tax credit would bolster American economic growth and productivity.

“R&D is not just another business expense,” Leino writes. “Rather, it is a key engine of long-term productivity and innovation. As Congress considers how to boost growth through better tax policy, immediate expensing of R&D spending and reducing the compliance burden of the R&D tax credit are the lowest-hanging fruit.”

“It is important to get R&D policy right, and tax policy is a key tool. Most clearly, companies should be allowed to fully deduct (expense) their R&D costs, as was the case prior to 2022,” Leino adds.

Alabama’s other U.S. senator, Katie Britt, is also a co-sponsor of the American Innovation and Jobs Act.

“My support of the American Innovation and Jobs Act emphasizes my continued commitment to putting hardworking Americans first. I’m grateful to join my colleagues in introducing this legislation to help small businesses invest in research and development with fewer barriers. It is absolutely imperative we remain global leaders in innovation, not only to outcompete the likes of China, but also to protect our national interests and support great American entrepreneurs,” Britt said in an official statement.