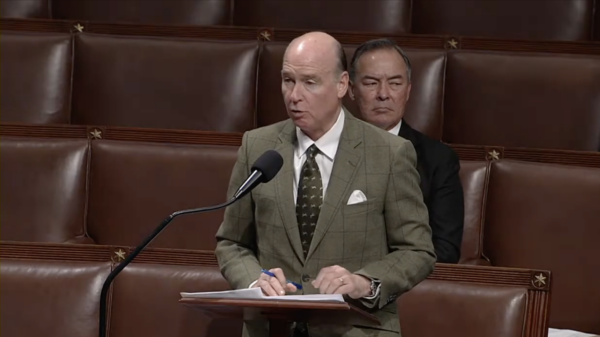

Earlier this week, U.S. Sen. Katie Britt, R-Alabama, spoke on the floor of the U.S. Senate in an attempt to rally support behind the Child Care Availability and Affordability Act, which she introduced earlier this year alongside U.S. Sen. Tim Kaine, D-Virginia.

The Child Care Availability and Affordability Act looks to increase the size of the Child and Dependent Care Tax Credit and make it refundable, with the intention of increasing child care access for low-income families. Under the legislation, the maximum child care tax credit would be expanded to $2,500 for families with one child and $4,000 for families with two or more children. By making the credit refundable, the legislation would allow families who do not earn enough money to owe federal income taxes to still benefit from the credit.

Additionally, the act would increase the amount that a family can deduct from their child care expenses through the Dependent Care Assistance Program. DCAP allows employees to set money aside from their paycheck before taxes to pay for qualified dependent care expenses, including childcare. The legislation would also decouple the DCAP from the CDCTC, allowing eligible families to benefit from both when their child care expenses exceed the DCAP threshold.

The Employer-Provided Child Care Tax Credit, commonly known as 45F, would also be bolstered under the legislation to incentivize more businesses to provide child care coverage for their employees. Currently, that credit is capped at $150,000, but Britt and Kaine’s plan would increase the maximum credit to $500,000 for traditional employers and $600,000 for small businesses, with the maximum percentage of expenses covered by the credit increased from 25 to 50 percent.

“More and more colleagues have joined the Child Care Availability and Affordability Act. As we work to build back America, it just makes sense. I was proud to introduce this legislation with Senator Tim Kaine, and we believe it will help address our nation’s child care crisis,” Britt said while addressing the Senate floor earlier this week. “Supporters are both Republicans and Democrats, they’re both parents and grandparents who understand how incredibly difficult it is to find affordable, high-quality, reliable childcare.”

Britt emphasized that access to affordable child care is a non-partisan issue and that the bill’s reforms have bipartisan support.

“Recent polls show that… 81 percent of America believe(s) affordable and available childcare is an issue that everyone should be concerned with, regardless of whether they have children or not,” Britt stated.

“Seventy-two percent of Republicans say increasing federal funding for child care is an important priority and a good use of taxpayer dollars – 70 percent of independents, and 90 percent of Democrats agree,” the senator continued. “Three out of every four Americans believe that the lack of childcare impacts the ability of businesses to function effectively and consistently. The message from voters is absolutely crystal clear.”

A recent press release from the senator also highlighted polling data which estimates that 85 percent of Americans support bolstering the Child and Dependent Care Tax Credit, Dependent Care Assistance Program and Employer-Provided Child Care Tax Credit as outlined in Britt and Kaine’s bill.

Britt also emphasized the economic impact of America’s child care affordability problem.

“The American economy loses $122 billion a year because of the lack of affordable child care… Imagine the boost to our economy if we made this targeted investment in workers and in families. Consider a parent who may be a low-income individual, many of whom find the high cost of child care to be the single biggest barrier in reentering the workforce. We could empower those parents to get back to work and move off government assistance,” Britt said.

Alabama is a prime example of how high child care costs can harm America’s workforce. According to the Alabama House Commission on Labor Shortage, a lack of affordable child care in the state greatly contributes to Alabama’s low labor force participation rate, as many working-age Alabamians are forced to abandon potential employment in order to care for their dependents. The average annual cost for child care in the state was over $7,000 per infant or toddler as of 2022, posing a serious financial burden to even the median married couple in Alabama.

Alabama also suffers from a lack of access to child care in general. Sixty percent of Alabamians live in “child care” deserts, with a severe lack of child care providers in both rural and urban areas across the state. Low provider wages only heighten the lack of available and affordable child care for Alabama families, with the median child care worker in Alabama making less than $23,000 annually.

Although the Child Care Availability and Affordability Act already has several co-sponsors from both sides of the political aisle, Britt called for more of her Republican colleagues to support the bill as it has remained stalled in the Senate Finance Committee since its introduction in March.

“This is exactly the kind of pro-family, pro-Main Street, pro-worker legislation that has the ability to both transform our economy and support families. I am encouraged by the amount of support this legislation continues to build, but we can’t stop now. [The American people] are counting on Republicans… to be that party of families, party of parents, the party of hardworking Americans, and to actually deliver. I believe the American people are firmly behind us,” Britt said.