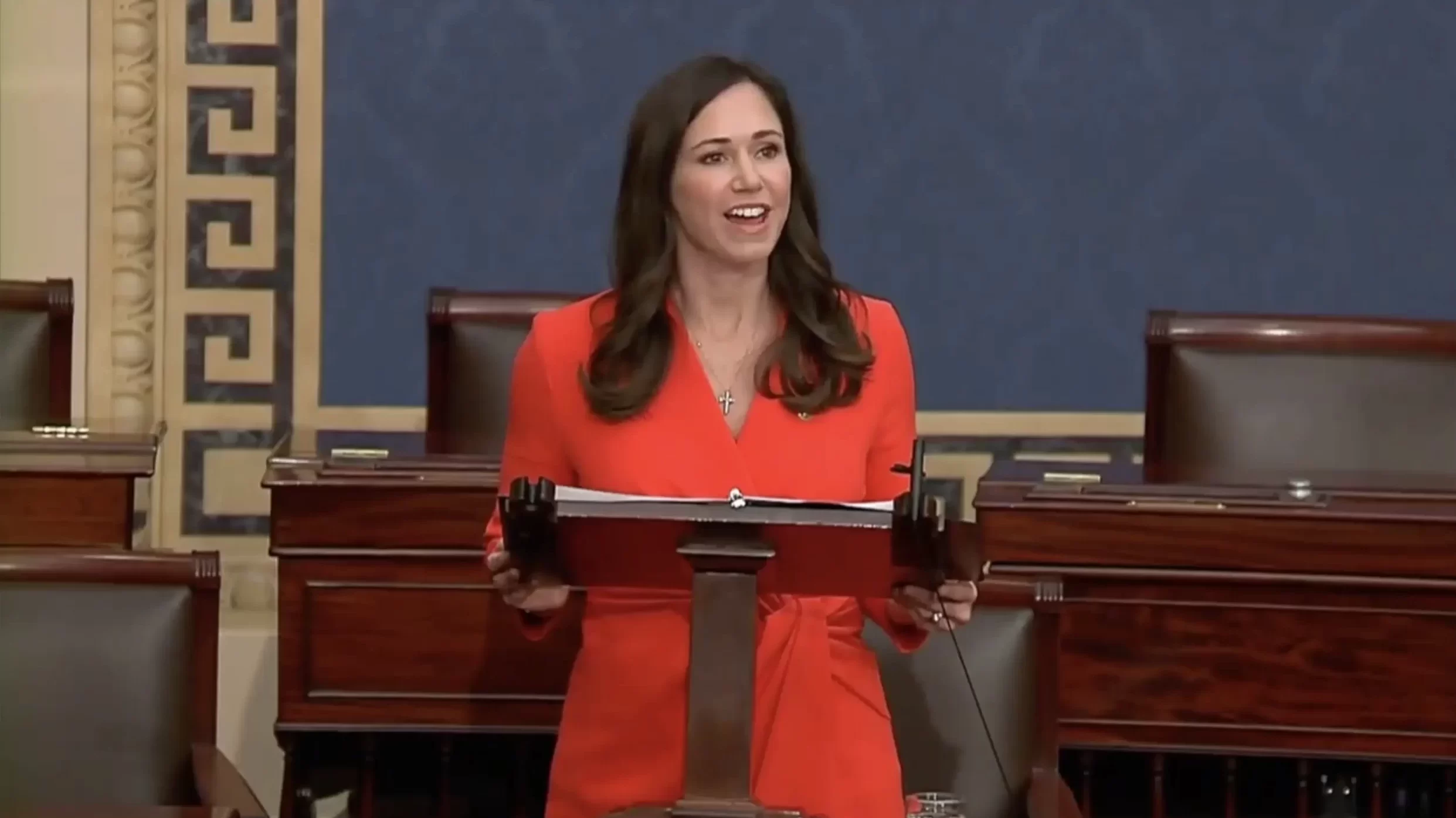

The newly released text of the Senate Finance Committee’s sweeping tax package—dubbed the One Big Beautiful Bill Act—includes several family-focused provisions long championed by U.S. Senator Katie Britt, R-Ala., including key updates to child care tax credits.

The legislation, led by Senate Republicans, would permanently extend major provisions of the 2017 Trump-era tax cuts while introducing new relief aimed at middle-class families. Among its updates, the bill enhances the Child and Dependent Care Tax Credit (CDCTC), increases the Dependent Care Assistance Plan (D-CAP) to a maximum contribution of $7,500 from $5,000, and increases the maximum credit for the Employer Provided Tax Credit (45F) to $500,000 for large businesses and $600,000 for small businesses.

Senator Britt praised the inclusion of the expanded credits, saying, “I have long championed the need for updated child care tax credits to help parents grow their families and to help strengthen our economy and workforce. An overwhelming majority of American families, 81% of parents, have called on Congress to address the affordability and accessibility of child care. Senate Republicans responded by including critical updates to child care tax credits in the One Big Beautiful Bill Act. Families and small businesses across the U.S. understand that child care is not a partisan issue, it’s a parents’ issue.”

Britt framed the reforms as a meaningful first step toward broader relief for working families. “I’m glad to see several of my pro-family priorities included in reconciliation—this is a great step in the right direction,” she said. “I will continue fighting to get this over the finish line for hardworking families.”

She also emphasized the broader vision driving her policy efforts: “Republicans are the party of parents, the party of families, and the party of hardworking Americans. I can think of no better way to reaffirm this big tent coalition than to tackle the affordability and accessibility of child care head-on by modernizing and strengthening these existing child care tax credits. I’m proud to help parents save money and pave their family’s pathway to the American Dream.”

With child care costs continuing to climb and labor force participation among mothers still lagging behind pre-pandemic levels, proponents argue that the updated credit will ease financial pressure on working parents while helping businesses attract and retain employees.

Taken together, these reforms represent one of the most significant federal investments in working families in over a decade. Britt’s provision is seen as a pragmatic and business-friendly solution, designed not only to ease financial pressure on families but also to empower employers to attract and retain talent. The child care measures in this bill reinforce Britt’s role as a national voice on pro-family economic policy within the Republican Party—and signal growing recognition that economic prosperity begins with strong, supported families.

The bill still faces hurdles in the full Senate and negotiations with the House, but its release signals progress on a core component of the Republican economic agenda—and a clear policy victory for Britt’s pro-family platform.