The U.S. House Administration Committee will hold a hearing today examining past attempts to restrict congressional stock trading, providing new momentum behind the bipartisan Restore Trust in Congress Act.

The bill, introduced by Rep. Chip Roy, R-TX, and championed by the nonpartisan Campaign Legal Center, would ban members of Congress, along with their spouses and dependent children, from buying and trading individual stocks.

Kedric Payne, CLC’s vice president, general counsel, and senior director of ethics, said in a statement that the public deserves leaders “who put public good over their personal financial interests.”

He argued that when lawmakers hold or trade stocks that could be affected by legislation or by nonpublic information they receive through their official roles, it creates what he called “the very definition of a conflict of interest.”

Reformers say existing law isn’t enough. Under the 2012 STOCK Act, which Congress passed in response to earlier insider-trading scandals, lawmakers are required to disclose trades within 30 days and are prohibited from using special access to information for personal financial gain.

But CLC and other watchdogs argue that weak penalties and lax enforcement have left loopholes wide enough for frequent traders to continue business as usual.

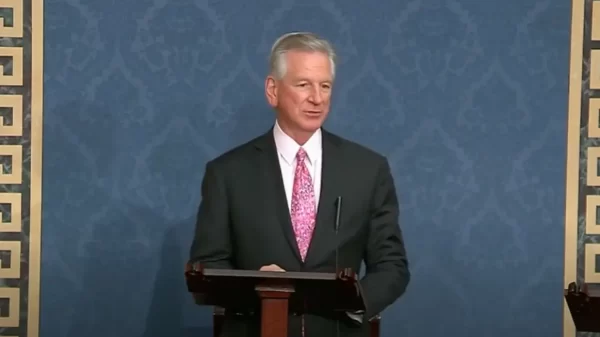

Forty-five percent of the current Congress owns stock, but few members of Congress have drawn more scrutiny in this space than Sen. Tommy Tuberville, R-AL. Since taking office, Tuberville has emerged as one of Capitol Hill’s most active traders, logging more than 1,100 transactions adding up to more than $34 million in reported activity. Public disclosures show he has traded stock in at least 270 companies, spanning technology, biotech, defense and agriculture.

Tuberville has made headlines for late filings under the STOCK Act. In 2021, he failed to report roughly 130 trades within the required window, a lapse that encompassed hundreds of thousands of dollars’ worth of transactions and prompted questions about whether congressional disclosure rules were being taken seriously.

His eventual filings showed he had executed more than $1 million in trades during his first five months in office. His office has said financial advisors manage the transactions on his behalf. However, watchdogs counter that lawmakers still bear responsibility for ensuring their investments do not overlap with their legislative influence.

Some of Tuberville’s trades have raised pointed questions about potential conflicts. His purchases of Alibaba stock, despite his hard-line public stance on China, drew national attention. So did recent transactions involving Humacyte, a biotech company linked to medical treatments relevant to Ukraine war injuries, at a time when Tuberville sits on the Senate Armed Services Committee.

The CLC argues that when lawmakers sit on committees overseeing industries in which they also hold investments, it creates unavoidable conflicts of interest or, at a minimum, the appearance of self-dealing.

The Restore Trust in Congress Act would force active traders to move holdings into diversified funds or blind trusts, effectively blocking lawmakers from buying and selling individual stocks that could be affected by their official duties.