At Global K9 Protection Group, our mission is to keep the people of Alabama safe. That depends on a healthy, reliable workforce and benefits our employees can actually use. Like families across the state, we’re managing rising costs that stretch every paycheck. When it comes to health care, especially prescription drugs, Congress should avoid new mandates that make a tough situation worse for employers and workers.

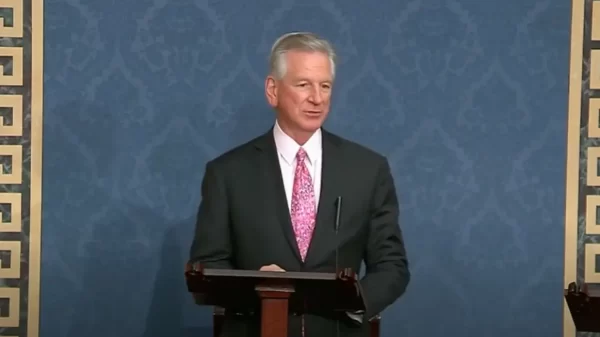

As the health care debate continues, we’re counting on Senators Britt and Tuberville to stand up for Alabama employers and families by rejecting policies that interfere with the private market and drive-up costs. Employers need the freedom to design plans that fit our people and our budgets, not one-size-fits-all rules that limit our options and increase health care expenses, including premiums.

Here’s what that looks like in practice. Employers use a range of private-sector tools to manage prescription spending and structure benefits so that overall costs are kept in check and savings flow back into our health plans. That flexibility helps companies like mine offer coverage that fits real-life needs, security professionals on variable shifts, veterans transitioning to civilian life, and K-9 handlers with unique family circumstances—without blowing up our budget.

Some proposals in Washington, pushed by large drug manufacturers, would move us in the wrong direction. They would inject new federal mandates into the commercial market where employers buy coverage, restrict how we contract for pharmacy benefits, and remove the very performance-based incentives that help us see more savings that we’re able to use to provide our employees with better benefits.

One type of policy that gained traction last year but was thankfully not enacted is legislation that mandates PBMs pass through 100 percent of the rebates they secure back to plan sponsors. A recent report examined what that proposed federal policy from 2024 would do and included, “In short, employers are not inclined toward a ‘one size fits all’ arrangement with their PBM and have different preferences for risk sharing … It is clear from recent survey data that requiring a 100 percent pass-through financial model would contradict the expressed preference of most employers. And, given the risk and uncertainty associated with rebates, prohibiting flat dollar arrangements could increase financial risk on employers.”

When you strip away employer flexibility and limit market negotiation, costs don’t disappear – they shift to workers and businesses.

Another misguided policy would sever how employers and their pharmacy benefit managers, PBMs, share in savings achieved through negotiated rebates secured from drug companies. In plain terms, it would undermine the very savings our partners, the PBM, help us secure from drug companies.

Independent analyses suggest policies like this would add billions in new costs in the private market each year by the way of increased premiums, more than $26 billion annually. Those dollars don’t create better benefits; they come out of family budgets and employer benefit funds while boosting drug company pricing power. In fact, while savings are actively being taken from consumers and patients, drug companies would actually reap $22 billion in increased profits.

Weakening the private market and undermining PBMs’ ability to negotiate doesn’t help patients at the counter. It reduces competition, limits plan design, and makes it harder for employers to keep coverage robust and savings possible.

If lawmakers remove or restrict these tools, employers face higher overall costs and fewer options to tailor benefits. That forces tough choices: scaling back coverage, increasing cost-sharing, or cutting elsewhere in the business. None of those outcomes make our workforce healthier or our communities stronger.

Senator Britt has cautioned that Congress must be smart about health care and avoid policies that pile on costs. I encourage her, and the entire Alabama delegation, to reject proposals that undermine employers contracting flexibility and private-market competition. Preserve the ability for employers and insurers to use performance-based contracts, negotiate rebates and discounts, and structure benefits that reflect our workforce’s needs.

Alabama employers aren’t asking Washington to manage our benefits. We’re asking Congress not to make it harder for us to do the job. Protect competition. Protect employer flexibility. And protect the private market mechanisms that help us offer affordable, dependable coverage to the people who keep our communities safe.