A bill that could lower prescription drug costs for Alabamians passed the Alabama State Senate 27-0 on Wednesday.

The bill—if passed in the House of Representatives and signed into law—will outlaw “gag clauses” used by pharmacy benefit managers. These contractual gag clauses keep pharmacists from informing a customer they could save money by purchasing a prescription out-of-pocket, rather than through insurance.

The reason that prices may be higher when purchasing via insurance is this: pharmacy benefit managers, companies that “manage drug benefits for insurers and employers,” as described by the New York Times, can charge a copay more expensive than the prescription itself and then “clawback” some of that copay from pharmacists. When clawback is protected by gag clauses, it is hard for consumers to know that they are being overcharged. Clawbacks are banned under the new bill.

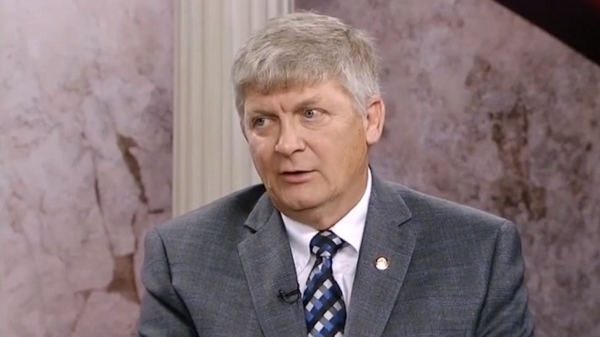

“This bill is about protecting the individual consumer,” said Sen. Arthur Orr (R-Decatur), who proposed the bill. “And allowing local pharmacists to inform their customers when it would be cheaper for the customer to buy a prescription drug with cash, out-of-pocket.”

Many other state legislatures have passed similar legislation outlawing gag clauses. As of May 2019, 33 states have banned the gag clause, including three states this year, according to an article by the National Conference of State Legislatures.

Action has even been taken at the federal level to prevent these clauses and subsequently lower drug prices for Americans. In October 2018, President Trump signed two bills into law—the Know the Lowest Price Act and the Patients’ Right to Know Drug Prices Act—aimed at preventing gag clauses and promoting greater visibility in drug prices.

“You should have transparent pricing in the healthcare market, and consumers should know which options are most affordable for them and their families,” Orr said.

The trend to protect consumers from often outrageous drug prices comes at a time when many Americans find themselves overpaying for prescriptions they need. In 2013, a USC study found that patients overpay at least $2.00 for their prescriptions 23 percent of the time. In the six-month period during which the study was conducted, the overpayments consumers made totaled $135 million.

“Senate Republicans are committed to lowering healthcare costs for Alabama families, and I commend Senator Orr for sponsoring this important legislation,” said Senate Majority Leader Greg Reed (R-Jasper).

Senate Bill 73 now moves to the House of Representatives for deliberation. There are eight legislative days left in the 2019 regular session.

“At the end of day, we want consumers to be able to shop for the best deal possible in the prescription drug market—that’s one of the keys to driving drug costs down for Alabama families,” Orr said.