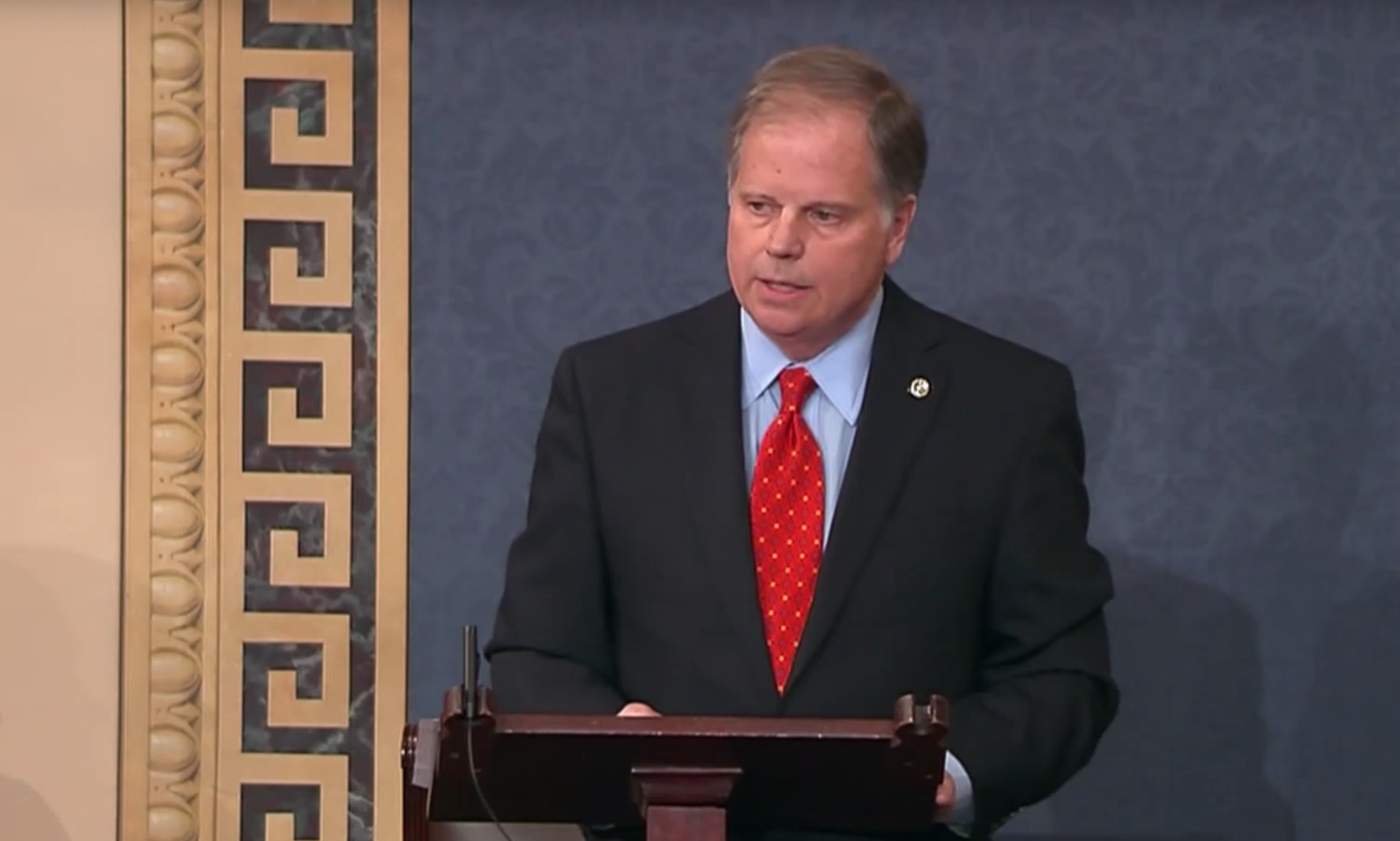

U.S. Sen. Doug Jones, D-Alabama, and a Republican colleague on the Senate Banking Committee on Wednesday called for a prohibition on “unsolicited predatory loans” during the COVID-19 crisis.

Jones and Sen. Tom Cotton, R-Arkansas, reintroduced their Unsolicited Loan Act, which would stop the practice of mailing high-interest loans to the public in the form of “live” checks.

“As you consider the next pandemic relief package, we write to highlight financial scams where Americans are being sent unsolicited ‘live checks’ – i.e. checks can be immediately cashed – precisely at a time when 88 million citizens are eagerly awaiting checks for their Economic Impact Payment,” the senators wrote in a letter to bipartisan Senate Banking Committee and House Financial Services Committee leaders on Wednesday. “Consumers have recently been confused when they receive unsolicited loan checks in the mail and cashing them thinking that they are government stimulus checks. Instead they’re further in debt.”

“We urge you to consider including the Unsolicited Loan Act in the next coronavirus package. This will ensure that taxpayers navigate these stressful times without any additional unnecessary economic hardship,” the letter continues.

The bipartisan legislation is supported by the National Consumer Law Center.

The full letter is below:

May 6, 2020

Dear Chairman Crapo, Ranking Member Brown, Chairwoman Waters, and Ranking Member McHenry:

As you consider the next pandemic relief package, we write to highlight financial scams where Americans are being sent unsolicited “live checks” – i.e. checks can be immediately cashed – precisely at a time when 88 million citizens are eagerly awaiting checks for their Economic Impact Payment (EIP). To be clear, these checks arrive from entities that have zero relationship to these consumers. The consumer never took a single action requesting these checks: not one mouse-click, not one phone call.1

In response, we ask that this predatory practice be addressed in the next package by including S.3036, The Unsolicited Loan Act, to prohibit lenders from providing unsolicited loan checks.

Unsolicited loan checks arrive in the mail and consumers may unknowingly cash them believing that the checks are from the government or their trusted financial institution. However, these checks are actually high-interest loans that consumers are obligated to repay the loan based on the terms of the contract.2 We note that the 88 million people awaiting their EIP checks are disproportionately elderly or receiving disability income.

With your leadership, Congress allocated funding to go directly to consumers in the CARES Act (H.R. 748) to help put food on their tables and keep a roof over their head. Unfortunately, consumers have recently been confused when they receive unsolicited loan checks in the mail and cashing them thinking that they are government stimulus checks. Instead they’re further in debt. Of course, these companies are free to make loans to these consumers anytime they wish, provided the loan has been requested.

We urge you to consider including the Unsolicited Loan Act in the next coronavirus package. This will ensure that taxpayers navigate these stressful times without any additional unnecessary economic hardship.