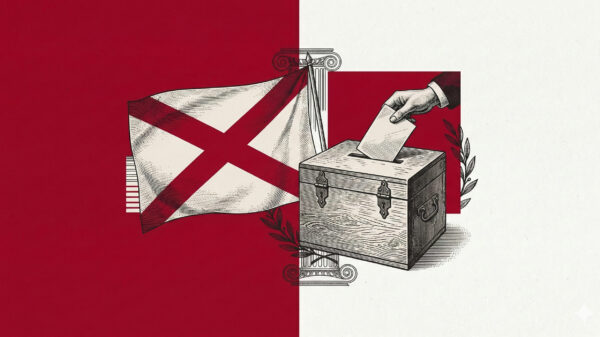

Alabama counties are projected to spend nearly $1 billion this year to keep sheriff’s offices and jails operating, according to new county-by-county data released Wednesday by the Association of County Commissions of Alabama.

Alongside the data, ACCA issued a strong warning that ongoing legal challenges to Alabama’s Simplified Sellers Use Tax (SSUT) program pose a direct threat to the funding that keeps these essential public safety operations functioning.

Serious Threat to Public Safety Funding

As the primary law enforcement agency in each county, sheriff’s offices carry out a wide range of critical responsibilities, from patrol and emergency response to criminal investigations and complete jail administration. As a result, in most Alabama counties, law enforcement operations consume more than half of the county’s total budget.

“Counties rely heavily on SSUT revenue to meet rising operational costs, and any reduction would effectively defund county law enforcement,” said ACCA Executive Director Sonny Brasfield. “Because counties do not have the authority to raise replacement revenue, any dollars lost through changes to SSUT are dollars that simply disappear.

“SSUT dollars keep deputies on the roads, jails staffed and communities protected. These costs are real, they are increasing and they fall squarely on counties. Weakening SSUT would immediately compromise the ability of sheriff’s offices to respond quickly, maintain patrol coverage and protect the people of Alabama.”

Constitutionally-Sound Structure of SSUT Program

Created in 2015, Alabama’s SSUT program requires out-of-state sellers to collect and remit use tax on purchases made by Alabama consumers. The program complies with the U.S. Supreme Court’s Wayfair ruling by keeping the process simple and avoiding any undue burden on interstate commerce, applying a single 8 percent rate across Alabama’s more than 3,000 local taxing jurisdictions and then distributing the revenue among state, county and municipal governments.

Although often referred to as an “online sales tax,” SSUT is actually a simplified method for collecting use tax. Sales tax is due only on in-state purchases; it is not owed on purchases from out-of-state sellers or of out-of-state goods. Instead, those transactions are subject to use tax — revenue that largely went uncollected prior to SSUT — which the program now ensures is collected.

This past year alone, SSUT generated nearly $1 billion for state and local governments. Ending or weakening the program would not increase revenue — it would simply eliminate collections from many out-of-state retailers, stripping the entire state of Alabama of essential funding, according to the ACCA.