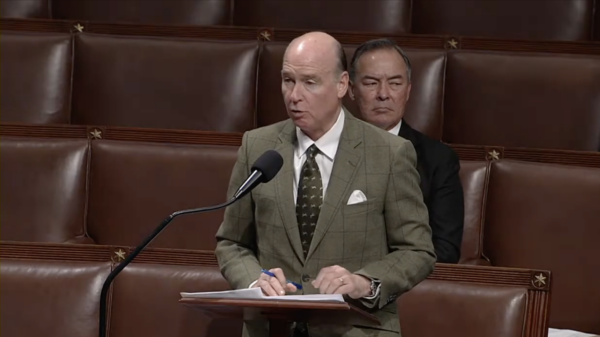

On Wednesday, Alabama Congresswoman Terri Sewell proposed two amendments to House Republicans’ budget proposal, also known as the “One Big Beautiful Bill Act.” One amendment called to increase eligibility for the Affordable Care Act’s premium tax credits and the other would have cut a major new tax credit meant to fund private school scholarships.

As one of two Democrats representing the state of Alabama in Congress, Sewell has repeatedly attacked the One Big Beautiful Bill as a giveaway to the wealthy and big corporations and for its effects on the country’s social safety net. While introducing her amendments, Sewell angrily called the legislation “the big billionaire boondoggle bill.”

A preliminary analysis of the budget proposal published by the Congressional Budget Office on Tuesday estimated the bill would reduce household resources of the poorest ten percent of Americans by between two and four percent between 2027 and 2033. At the same time, the CBO estimated, “resources would increase by an amount equal to 4 percent for households in the highest decile in 2027 and 2 percent in 2033.”

Another analysis produced by Penn Wharton Budget Model, a nonpartisan research initiative based at the University of Pennsylvania, calculated the median American in the bottom quintile by income would see their “after-tax-and-transfer income” fall by 6.8 percent, while the top one percent would see income increases of a bit over two percent.

Experts at left-of-center think tanks and policy institutes are most worried about proposed cuts to America’s social safety net programs, like SNAP and Medicaid. Sewell has consistently supported legislative proposals that would protect or expand these programs, including her first amendment to the budget proposal.

“My first amendment, amendment number 209, would extend the Affordable Care Act’s premium tax credits to Americans in non-Medicaid states like Alabama who are caught in this coverage gap, as well as Americans who have lost Medicaid coverage as a result of the Republican cuts in this bill,” Sewell said. “1.5 million Americans are in the Medicaid coverage gap. These are the working poor.”

“In my state, Medicaid is a bare bones, minimum program,” the congresswoman said. “You have to be really, really poor. Back home in Alabama, we call it being ‘po.’ You can’t afford the ‘o’ or the ‘r’ in order to get Medicaid in my state.”

Sewell clarified on social media that Amendment 209 was based on the Bridge to Medicaid Act, which she introduced earlier this month alongside Shomari Figures, her fellow Democratic member of Congress from Alabama.

Sewell’s second proposed amendment would simply strike section 110109 of the budget proposal. That section would create “dollar for dollar” tax credits for anyone who donates to select scholarship funds meant to help students attend private or religious institutions.

By reducing tax liabilities by one dollar for every dollar donated, section 110109 is essentially equivalent to federal funding of scholarship programs. And Carl Davis of the Institute on Taxation and Economic Policy explained in March that these types of tax credits could help facilitate wealthy proponents of school choice paying millions less in taxes.

During the Congressional committee meeting on Wednesday, Sewell compared the proposed tax credits to Alabama’s Education Scholarship Program. “My home state of Alabama has adopted a dollar-for-dollar tax shelter for donations to voucher schemes,” she pointed out.

“The private school voucher scheme is modeled after states like Alabama,” Sewell said. “Many Southern private schools were established during and after integration. Today, these same schools are benefiting from taxpayer dollars flowing rapidly, expanding voucher programs that are rampant with waste, fraud, and abuse.”

The Congresswoman also highlighted some of the other common critiques of school choice programs. “In the state of Alabama, school choice doesn’t really mean a choice when you live in small, rural communities that only have two schools, one that is public and all black, and one that is private and all white,” Sewell said.

While the CHOOSE Act, and the Education Scholarship Program before it, have seen fairly high adoption rates, many in Alabama remain concerned about the geographic distribution of eligible private schools and public dollars going to fund private religious education.

The One Big Beautiful Bill Act passed the House Wednesday morning with a vote along party lines despite Senator Josh Hawley, R-Missouri, publicly telling his Republican colleagues to shy away from Medicaid cuts. As written, the bill will also require significant cuts to Medicare due to the Pay-As-You-Go Act triggering automatic decreases in funding to offset deficit spending.