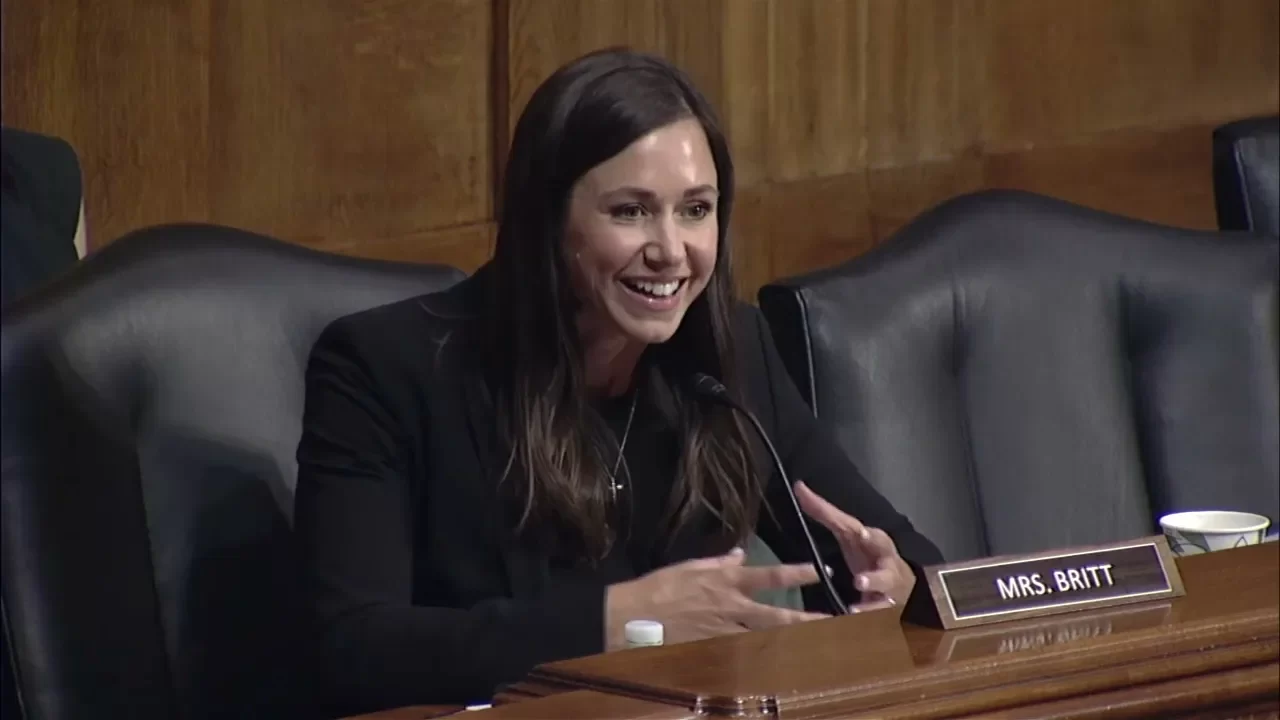

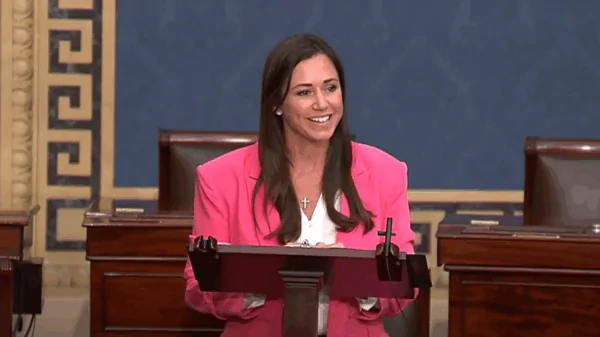

Sen. Katie Britt, R-Alabama, a member of the Banking Committee, joined Senator Bill Cassidy, R-Louisiana, and several other Senate Republicans in sending a letter to the acting administrator of the U.S. Federal Emergency Management Agency, David Richardson.

In their letter, the senators call for “the elimination of Risk Rating 2.0, a Biden-era policy that has caused flood insurance premiums to soar for families across the country, without transparency into the program’s methodology,” Britt’s release said.

“Since the Biden Administration’s rollout of Risk Rating 2.0, premiums under the National Flood Insurance Program increased in every state. By FEMA’s own estimates, 77 percent of all NFIP policies now pay more than under the old system,” wrote the Senators.

“The lack of transparency surrounding Risk Rating 2.0 is beyond troubling. FEMA has never allowed for meaningful public comment nor has it published the underlying data or assumptions used to justify the steep premium increases and refuses to disclose its actuarial model. Without transparency, communities cannot plan mitigation projects, lenders cannot accurately underwrite mortgages, and citizens cannot appeal punitive rate increases. Worse still, rising costs encourage policy lapses—shifting risk back to taxpayers when disasters strike,” the senators continued.

“The rate at which we’re seeing flood insurance premium increases is staggering. In Alabama, as of August 2023, Risk Rating 2.0 would increase these premiums for homeowners by around 106 percent. This is unacceptable, and it’s the result of a Biden-era policy we must end. I’m proud to work alongside my colleagues to provide needed transparency surrounding FEMA’s actuarial models, and protect homeowners in Alabama, without subjecting them to exorbitant premiums,” Britt said.

As of August 2023, the latest available FEMA data, Risk Rating 2.0 would increase annual NFIP premiums for homeowners in Alabama by about 106 percent. It is estimated that 79 percent of Alabama NFIP policyholders experienced monthly premium increases in 2025, as a result of Risk Rating 2.0. Additionally, over the last 12 months, about 1,200 Alabamians have left the NFIP as a result of premium increases.