On Tuesday, the U.S. Senate passed its version of the “One Big Beautiful Bill Act,” the omnibus domestic policy bill most notable for its severe cuts to social services like the Supplemental Nutrition Assistance Program and Medicaid in order to fund increases in tax breaks for the wealthiest Americans. The amended legislation will now go back to the House from where, if passed without further amendment, it will then be sent to President Trump’s desk to be signed into law.

While critics have mostly focused on the harm which the bill’s cuts to SNAP and Medicaid will cause to millions of Americans (U.S. Sen. Bernie Sanders, I-VT, called the bill “the most dangerous piece of legislation in the modern history of our country“), the nearly 900-page legislation contains a myriad of other provisions — and among them are significant increases to tax credits for child care.

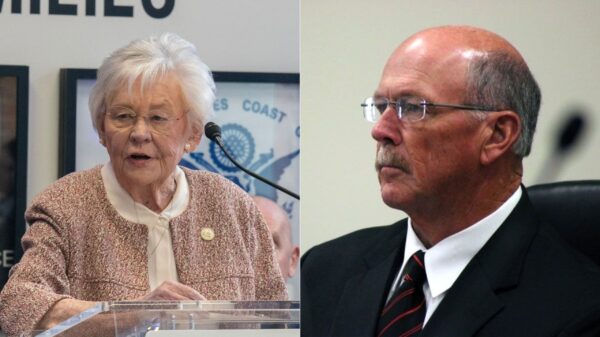

U.S. Sen. Katie Britt, R-Ala., has focused much of her attention during the 119th Congress on pushing for child care reform, specifically through the bipartisan Child Care Availability and Affordability Act, which she introduced alongside Sen. Tim Kaine, D-VA, earlier this year. Among the legislation’s provisions are increases to the Child and Dependent Care Tax Credit, Dependent Care Assistance Program, and the Employer-Provided Child Care Tax Credit (45F). Many of those same provisions are now included in the Senate reconciliation bill as it heads to the House.

Included in the Senate bill is a permanent increase to the Child and Dependent Care Tax Credit from 35 percent to 50 percent of qualifying expenses. According to the Journal of Accountancy, the credit rate “would phase down for taxpayers with adjusted gross income over $15,000. It would be reduced by 1 percentage point (but not below 35 percent) for each $2,000 that the taxpayer’s AGI exceeds $15,000. It would then be further reduced by (but not below 20 percent) 1 percentage point for each $2,000 ($4,000 for joint returns) that their AGI exceeds $75,000 ($150,000 for joint returns).”

Additionally, the legislation would increase the maximum annual amount excludable from income under DCAP from $5,000 to $7,500, the same provision put forward in Britt and Kaine’s legislation.

The Senate bill would also expand 45F, the Employer-Provided Child Care Tax Credit, in accordance with the provisions of the Child Care Availability and Affordability Act. As in Britt and Kaine’s legislation, the Senate bill would increase the amount of qualified child care expenses from 25 percent to 40 percent and expand the maximum credit amount from $150,000 to $500,000 (and $600,000 for eligible small businesses). The credit would also be adjusted for inflation.

Britt celebrated the Senate’s passage of the bill and its inclusion of these child care reforms in an official statement Tuesday.

“This is about more than just addressing our child care crisis – it is a direct investment in the hardworking families and local small businesses striving to achieve their American Dream across our nation. I’m proud to lead my colleagues in securing this historic win, which empowers parents, opens the door to more opportunities for their children, and tackles our nation’s urgent workforce needs to help unleash a new era of American prosperity,” said Britt. “Getting this bill over the finish line will send a strong message to the American people that we can and will get the job done to improve the affordability and accessibility of quality child care. I’ll continue to fight for pro-family, pro-Main Street, and pro-growth policies that strengthen our communities, our economy, and our nation.”

In her official press release, Britt also noted that the CDCTC and 45F have not been permanently updated since 2001, when child care costs were 263 percent lower than they are today. Meanwhile, DCAP has not been updated since 1986.

“The worsening child care crisis is holding families, child care workers, businesses, and our entire economy back. Across the country, too many families cannot find or afford the high-quality child care they need so parents can go to work and children can thrive. Over the last few decades, the cost of child care has increased by 263 percent, forcing families—and mothers, in particular—to make impossible choices,” reads the press release.

“More than half of all families live in child care deserts,” it continues. “Meanwhile, child care workers are struggling to make ends meet on the poverty-level wages they are paid and child care providers are struggling to simply stay afloat. The crisis—which was exacerbated by the pandemic—is costing our economy dearly, to the tune of $122 billion in economic losses each year.”

While the “One Big Beautiful Bill” is largely opposed by the American public, specific provisions, including the child care policies touted by Britt, do have strong popular support.

According to polling by the First Five Years Fund, over 90 percent of Republicans, Democrats and Independents think it’s a “problem or crisis” that many Americans can’t afford child care. Over 72 percent of Republicans and 90 percent of Democrats also said that investing in child care is a good use of tax dollars, with 86 percent of voters expressing support for increasing the CDCTC.

It remains unclear if House Republicans will be able to pass the reconciliation bill in its current form, or if some provisions may need to be stripped or reworked in order to achieve majority approval. Currently, Speaker of the House Mike Johnson, R-LA, and his allies are insistent that they will be able to pass the legislation before this Friday, July 4.