A group of Alabama’s largest city leaders is turning up the heat on Montgomery, backing a wave of lawsuits and legislation aimed at reforming the state’s outdated online sales tax structure.

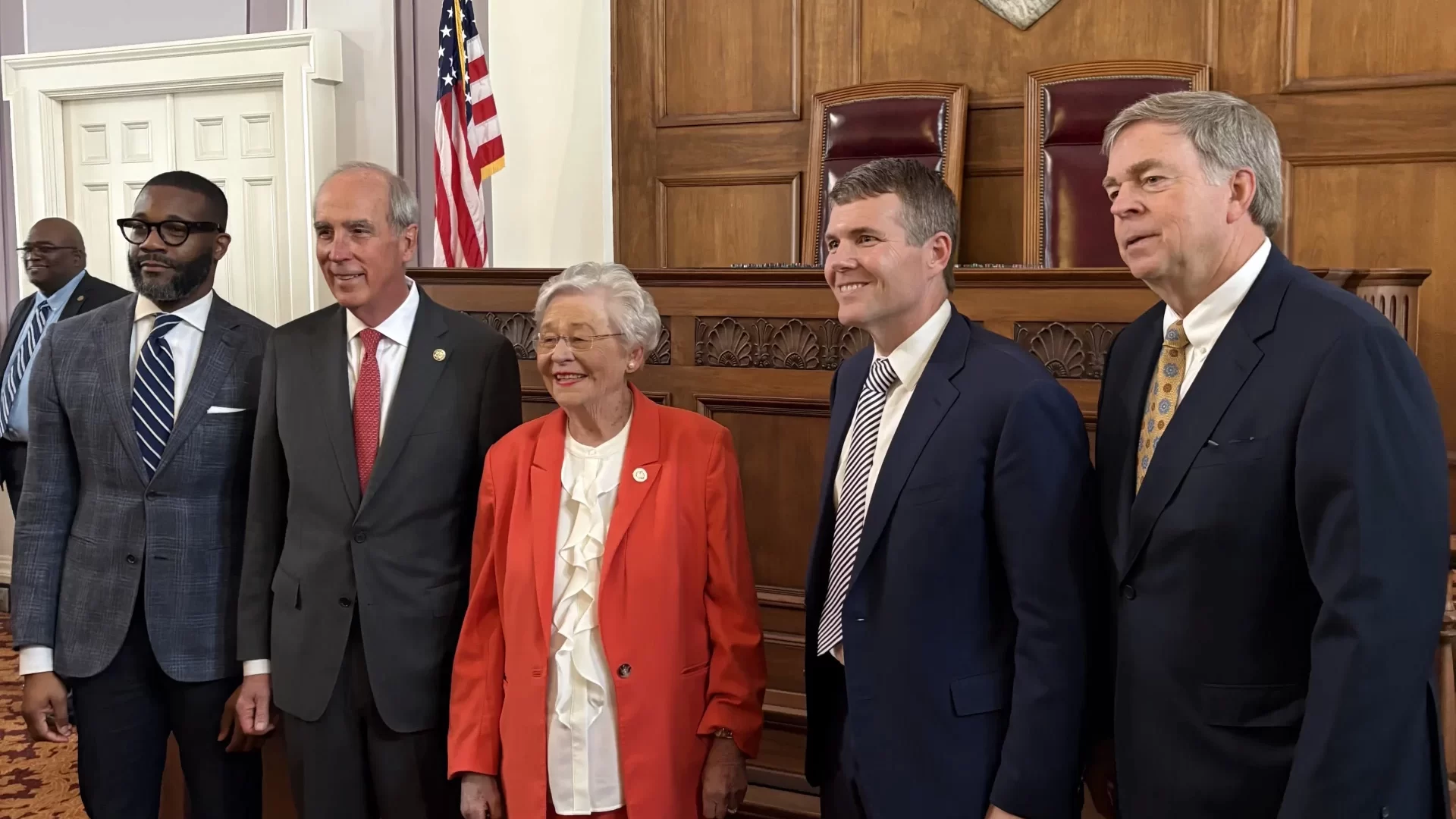

The Big 10 Mayors, who represent Alabama’s major municipalities, voiced their support this week for lawsuits filed by Tuscaloosa and Mountain Brook challenging the distribution of the Simplified Sellers Use Tax, or SSUT. They say the state’s decade-old system shortchanges cities, schools and small businesses.

“Between these lawsuits and numerous legislative efforts to address our state’s unfair online sales tax structure, it’s clear that there is a growing consensus to address SSUT,” the mayors said in a joint statement. “Its current structure is a problem for Alabama—it’s bad for municipalities, bad for schools, and bad for small businesses. It’s time to fix it.”

Created in 2016, the SSUT allows online sellers to remit a flat 8 percent sales tax. At the time, it was designed to attract voluntary compliance. But after the U.S. Supreme Court ruled in South Dakota v. Wayfair (2018) that states could require online sellers to collect sales tax, the original justification for the flat rate vanished. Alabama’s system, however, has remained frozen in time.

Under current law, half of SSUT revenue goes to the state’s General Fund. The other half is divided among cities and counties based strictly on population, not on where purchases are made or delivered. Local officials say that setup drains millions from communities generating the economic activity.

Tuscaloosa Mayor Walt Maddox said the formula is costing his city between $14 and $15 million a year. The Tuscaloosa City Council and the city’s school board have both voted to sue the state over the lost revenue. Mountain Brook has since joined the fight.

“The goods are bought in Tuscaloosa, delivered in Tuscaloosa, but the revenue gets spread across the state with no consideration for the local impact,” Maddox told NBC affiliate MyNBC15. “That’s not fair. That’s not sustainable.”

The mayors say the system is doubly flawed—it strips cities of the money they earn and gives online sellers an edge over local businesses. While Alabama retailers must charge the full combined local and state sales tax—often over 10 percent—online retailers get to collect just 8 percent.

In the most recent legislative session, Rep. Chris England, D-Tuscaloosa, introduced a bill to raise the SSUT rate to 9.5 percent, with the additional 1.5 percent dedicated to cities and public education. The bill failed to gain traction, but supporters say they will bring it back in 2026.

“We’re reaching a tipping point,” the mayors said. “Alabama’s communities deserve a tax structure that reflects modern commerce, supports local economies, and funds the public institutions that keep our state moving forward.”

With lawsuits mounting and pressure growing from both sides of the aisle, state leaders may finally be forced to confront what cities have known for years: Alabama’s online tax system isn’t just broken—it’s costing communities millions.