Alabama lawmakers were warned this week that changes to federal nutrition assistance rules could add more than $200 million in new annual costs to the state budget by 2028.

Before the Joint Legislative Budget Committee, Department of Human Resources Commissioner Nancy Buckner outlined how shifts in federal policy will shift greater responsibility for the Supplemental Nutrition Assistance Program onto states in the years ahead and just how much that could be.

“Starting in FY27, administrative costs will go from about 50/50 to 75 state, 25 federal,” said Buckner. “That’s going to be about $35 million more than what we have now.”

Currently, SNAP benefits are fully federally funded, but beginning in FY28, states will also be required to pay a share of benefits tied to their payment error rates. Alabama’s error rate for fiscal year 2024 was 8.32 percent. While that was the best performance in the Southeast region, it ranked only 16th nationally.

“For Alabama, that’s $173 million, if it’s what it is in 24,” said Buckner. “The total increase from 2026 to 2028 is $208,694,000.”

Some lawmakers expressed disbelief at the math, pressing Buckner on how they arrive at such a large cost estimate from what appeared to be a relatively small pool of cases. The federal review of Alabama’s 2024 error rate was based on 1,109 randomly sampled cases, of which 175 were found to have errors.

The dollar amount tied to those cases totaled about $36,000. The sample is used to project errors across Alabama’s nearly $2 billion SNAP caseload, resulting in a relatively modest total extrapolated into more than $170 million in estimated overpayments.

Some legislators questioned whether such a narrow snapshot should be the basis for budget-shifting penalties of that magnitude.

“You’re reading it right,” said Buckner.

Lawmakers also criticized the federal formula. A state would take their payment error rate and multiply it by 1.5. If this number were higher than 20 percent, a state would have two years before having to pay more for its benefits.

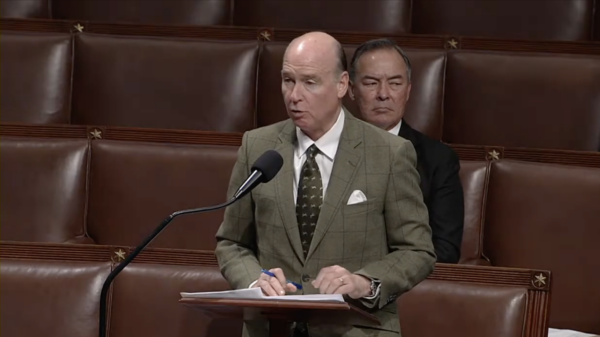

“The worse off you are, the better off you could become?” asked Senate General Fund Committee Chairman Senator Greg Albritton, R-Atmore.

“I can’t speak for who wrote the bill, but that is the math,” said Buckner.

Ten states with error rates above a federal threshold qualify for delayed implementation until 2030. Alabama, by performing better, must begin shouldering costs earlier.

Buckner told lawmakers that the causes of payment errors are divided evenly between agency mistakes and client reporting failures.

“Our error rate was about 48 percent agency errors, 52 percent client errors,” said Buckner.

Alabama has relied on automation through its ASAP program to save staffing costs, but automation also contributes to errors.

“When you’ve got a worker that’s carrying over 3,000 cases compared to the rest at about 550, you’re saving a lot of money,” said Buckner. “But the things that you do, you can get dinged on them for your error rate.”

Agency errors, she said, often come from caseworkers failing to process changes in a household correctly or overlooking provided documents. Even small missteps like not entering the correct income amount or miscalculating deductions are classified as errors, even if the household ultimately received the right benefit amount.

Client errors usually happen when recipients don’t report changes quickly, like a family member moving in or out, a child turning 18 or someone starting a new job. Federal rules require these changes to be reported promptly, but Buckner pointed out that many clients either don’t fully understand the rules or wait until their next recertification to report.

Lawmakers asked whether these mistakes ever counted as intentional fraud, but Buckner clarified that most client errors are unintentional and not attempts to cheat the system.

Fraud and security remain major concerns for the department. Buckner noted that Alabama recovers about $5 million a month in SNAP and TANF fraud, with the most serious cases referred to federal authorities.

Still, with these ongoing losses and the coming shift of federal costs to the state, several legislators questioned whether Alabama has the resources to keep the program both secure and financially sustainable.

“I’ve got $208 million staring at me on a screen that frightens me, and it should frighten everyone up here,” said Representative Andy Whitt, R-Harvest.