By Bill Britt

Alabama Political Reporter

According to the Federal Bureau of Investigation:

“Public corruption poses a fundamental threat to our national security and way of life. It impacts everything from how well our borders are secured and our neighborhoods protected…to verdicts handed down in courts…to the quality of our roads, schools, and other government services. And it takes a significant toll on our pocketbooks, wasting billions in tax dollars every year.”

Because public corruption is so detrimental to our Nation and State, socially as well as morally, it is important to understand how legal and illegal corruption in government is rooted in Asymmetric Information.

Asymmetric Information generally related to economics can be defined as “a situation in which one party in a transaction has more or superior information compared to another. This often happens in transactions where the seller knows more than the buyer, although the reverse can happen as well,” according to Investopedia.

Politicians, bureaucrats, lobbyists, special interests, and businesses use Asymmetric Information to their advantage in the political arena. Not unlike the car salesman, real estate agent, or doctor, privileged information creates an advantage for one player over another. While the internet has leveled the playing field in many areas, politics still remains a maze of complicated rules, laws, agencies, and hierarchy, that can leave even an astute observer at a decidedly stunning disadvantage.

Hidden information and actions can, and quite often do, actually cause harm to the very citizens the government is sworn to protect. This abuse is seldom discovered without vigilant watchdogs.

The citizens do feel the effects.

In State’s where Asymmetric Information is used to advance private interest over public good, there are tell-tale signs. They generally manifest themselves in quality of life issues. Poor education, limited health services, crumpling infrastructure, and slow economic grow are all signs of government corruption.

In a representative government, citizens elect others to act on their behalf, and then rarely question how that elected official carries out their duty, until something goes terribly wrong.

Meanwhile, hidden information and hidden action used by these representatives often leads to corruption, both legal and illegal.

In the Harvard University study, “Corruption in America Survey,” authors Oguzhan Dincer and Michael Johnston define legal corruption as, “political gains in the form of campaign contributions or endorsements by a government official, in exchange for providing specific benefits to private individuals or groups, be it by explicit or implicit understanding.”

Illegal corruption is stated as, “private gains in the form of cash or gifts by a government official, in exchange for providing specific benefits to private individuals or groups.”

However, under Alabama law, a quid pro quo arrangement doesn’t have to be proven for a politico to run afoul of the law.

There are many examples of how Asymmetric Information is used in politics to benefit a certain group or individual. Here, we will look at two legislative acts that were influenced by hidden information and hidden acts.

Such a case involves the State Insurance Premium tax. An insurance premium tax is the amount of tax paid on a given insurance policy. According to Lexis Nexis, “An insurance premium tax is a form of gross receipts or excise tax; it is not based on profits or earnings, and is not affected by the cost of ceded reinsurance or other expenditures, of an insurer.”

In 1985, the US Supreme Court held that Alabama insurance premium tax system was unconstitutional in Metropolitan Life v. Ward.

Prior to the 1985 ruling, domestic carriers paid a rate of 3.0 percent while out-of-state carriers paid 4.0 percent.

The Court held the State law violated the equal protection clause, and that a State could not charge out-of-state insurance (foreign) companies a higher premium tax than domestic insurance carriers. To address the US Supreme Court ruling, the State passed the Insurance Premium Tax Reform Act of 1993, which set the Premium tax rate at 3.6 on both foreign and domestic carriers.

From 1993 until 1995, the State’s largest insurance business (ALFA) would spend $2.3 million on political campaigns through its two political action committees, according to a 1997 report in the Wall Street Journal.

In 1995, the State legislature passed a new insurance premium tax system that, through a complicated scheme of incentives, would give ALFA a huge advantage over its competition.

According to former Revenue Commissioner under Gov. Bob Riley, and past president of Baldwin Mutual Insurance, Judge Tim Russell, this type of advantage hurt the citizens of the State, as well as companies that would do business here.

“Anytime you have a Premium tax that’s not fair to all concerned, you’re gonna hurt the citizens of the State, and the companies who can’t get that Premium tax,” Russell said.

Data provided from the Department of Insurance reveals that from 2008 to 2013, ALFA would receive over $70.6 million in Premium tax credits from the State.

Other carriers have since learned to take advantage as well, but ALFA’s benefits from the 1995 law are clearly demonstrated by the data.

However, it is important to note that tax credits vary from ALFA’s property and casualty tax of 1.6 percent, to Allstate’s at 3.45 percent, whereas companies like GEICO do not take a tax credit; therefore they pay the maximum of 3.6 percent.

Here is a case, in my opinion, where political contributions led to passage of a set of laws that benefited one particular company over others, while giving one set of customers a benefit at the detriment of others.

A comparison of insurance carriers paints a vivid picture of how Premium tax credits vary between companies. Data provided from the Department of Insurance reveals that from 2008 to 2013, ALFA, and State Farm combined received a total of around $140 million compared to Nationwide, who earned approximately $10 million in premium tax credits or less than 10 percent of the bigger players. From 2008 to 2013, the total for all insurance carriers receiving premium tax credits was $160.2 million.

If one family has ALFA coverage and the other has Nationwide, the one with ALFA will pay less on their premium tax.

Governor Bentley has called this an unfair tax, and had hoped to address this during the 2015 Legislative Session. Bentley’s plan estimated this would increase State revenue by $25 million per year. Most of the insurance premium tax goes to the General Fund Budget, and is, in fact, the single, largest contributor to the Fund.

According to Alabama Department of Insurance (ALDOI), over the last four years, the State’s General Fund has received $1,001,414,336 in revenue from the Premium tax paid in. In the same period, ALFA and State Farm have taken a combined total of $96,230,401 in tax credits, (estimated for 2014). The total for all companies taking advantage of the Premium tax credits was $110,443,705 (estimated for 2014).

Here, I believe Asymmetric Information held by certain business interests, lobbyists, and lawmakers led to passage of incentives that would benefit one company over another, dissuade growth in an industry, all the while creating a disparity in payments by consumers.

Why, after 20 years, should the State continue to incentivize ALFA?

Because, its PACs remain highly active in financing candidates to public office.

In my judgement, this is the type of legal corruption that the Harvard study defines as, “political gains in the form of campaign contributions or endorsements…in exchange for providing specific benefits to private individuals or groups, be it by explicit or implicit understanding.”

The study found that legal corruption in Alabama’s legislative branch is extremely common.

Twenty years after its passage, few remained who voted to give ALFA its tax advantage. Most legislators were not even aware of the incentive, or its negative impact on the General Fund Budget. Outside of the insurance community, even fewer average citizen has any knowledge of the disparity that cost many of them money, in the form of higher insurance rates.

After breaking the story on ALFA’s tax advantage in March 2015, two State Representatives claimed they were threatened by ALFA lobbyists. The Governor couldn’t find a single Republican House Member to carry his legislation to reform the insurance premium tax system.

In politics, Asymmetric Information used to pass legislation can lead to various forms of graft, coercion, and fraud.

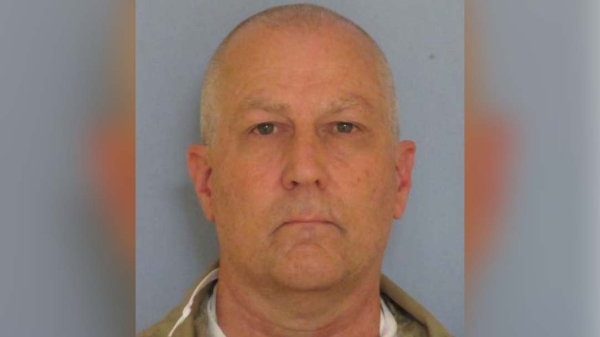

In October 2014, Republican Speaker of the House Mike Hubbard was arrested on 23 felony counts of public corruption. Hubbard was charged with using his office for personal gain, receiving cash and contracts from lobbyists, and business associates, and receiving assistance with his business interests from high-profile individuals and companies, including former Gov. Bob Riley.

After hearing from over 150 witnesses and reviewing thousands of documents, a Grand Jury of 18 citizens from Lee County found probable cause that Hubbard should be tried for these crimes.

The State alleges that Hubbard has committed acts of illegal corruption. In June 2013, this publication was the first to report that Hubbard had not only voted to passage legislation to benefit a business client, but that he had also arranged for 23 words to be inserted into the State’s Medicaid budget to benefit that client.

During the 2013 Legislative Session Hubbard worked to pass law that would have made his client American Pharmacy Cooperative Inc. (APCI) the sole company to provide Pharmacy Benefits Manager services to Alabama’s Medicaid agency. The resulting contract would have been worth an estimated $12 to $20 million annually.

According to the State, Hubbard, while Speaker of the House, was paid over $700,000 for illegal actions on behalf of various business clients, APCI being one.

At a time when the State was looking to better administer drug benefits to Medicaid recipients, Hubbard was looking out for his client, who was paying him around $7500. a month and himself. Here, Hubbard used the power of his office while hiding Asymmetric Information, which, if known, would have forced him to recuse himself from a vote. But, not only did Hubbard have language placed into the budget, he voted for its passage 12 times.

Once rumors started to surface around the State House that Hubbard had a client who would benefit from the passage of legislation, he arranged a meeting with the State Ethics Director to seek approval for the contract. Again, this was kept secret from other members of the House.

According to then Alabama Ethics Commission Director James L. Sumner, Hubbard informed him after-the-fact of a business agreement between Hubbard’s media company, Auburn Network Inc., and the Bessemer-based APCI. “He said it [the contract] was to provide several services is what I understood. I don’t recall that he went into detail.”

During the meeting, Sumner gave a verbal nod to the contract even through he admitted, “I never saw a contract and didn’t ask to see a contract.”

Hubbard had asked the Commission’s opinion on another contract with the Southeast Alabama Gas District (SEAGD). In writing, legal council for the commission Hugh Evans, III, warned Hubbard, “The only potential issue that we saw [with the SEAGD contract] would be if something came before the legislature that uniquely affected the Southeast Alabama Gas District differently than it affected all other utilities around the State of Alabama.”

Evans said, that should an issue that directly effected SEAGD come before the legislature, Hubbard “would expect … to remove himself from discussions, votes, etc.” Evan’s also stated in his opinion that, “the Speaker may not use his position or mantle of his office to assist him in …providing benefits to his … clients.”

In the indictments against Hubbard, the State says he ignored the warnings. He is also charged with committing crimes in relation to his work for SEAGD.

On several occasions, Hubbard met with Gov. Bentley, and other public officials were unaware of Hubbard’s financial arrangements which were contrary to the law according to the indictments.

In the case of APCI, or his other clients: Did Hubbard have the State’s best interests in mind or his own? In meetings with high ranking government and business leaders, Hubbard withheld pertinent information. He strategically used the power of Asymmetric Information for his personal gain. Hubbard could dupe fellow legislators, the Governor, and others, because he had hidden information. The real motivation behind his actions was hidden, giving him further advantage because his real agenda was unknown.

Secret contracts, private approvals and hidden payments, led to what the State calls a crime.

Hubbard is the self-proclaimed architect of the Republican take-over of State government in Alabama. He and his fellow Republicans offered transparency as a cornerstone of governing policies.

Rather than real reform, the same use of Asymmetric Information to gain advantage over legislation and the voters is still practiced.

This continues to foster a climate of legal and illegal corruption, which keeps our State at the bottom in almost every metric of progress. Just like the used car salesman, our politicians, bureaucrats, lobbyists, special interests, and businesses will continue to use Asymmetric Information to their advantage. The public, and especially the press, must demand more tools to end the politicos advantage, which almost always leads to public corruption.